Software enhancements made to Primo Payroll in the first half of May 2019

1.1 EMPLOYEE RECORD - ADDITIONAL TITLE

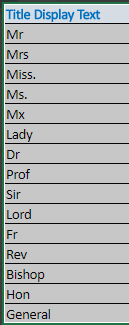

New titles have been added to the existing list which now lists the following:

Employee Record → Title

1.2 INCLUDE PG STUDENT LOAN IN EMPLOYEE IMPORT

You're now be able to add the PG Student Loan details in the employee import template.

Settings → Import Data → Employee Import Template

1.3 UTILITIES - DELETE P11

Our support team now have the option to delete the P11s (for which the FPS has been submitted). If you need to delete such P11s, then please raise a support ticket by sending an email to support@accentra.co.uk

1.4 COMPANY IMPORT - RTI TO USE BUREAU CREDENTIALS

If the ‘Agent’ details are specified in the bureau company, then the companies imported under this bureau will be set to use the RTI credentials of the bureau company.

Bureau Company → Settings → RTI → HMRC Settings → Agent Details

1.5 DOWNLOAD TAX CODE NOTIFICATIONS WITH "S" OR "C" PREFIX

Primo Payroll will now download the Scottish & Welsh tax codes and when you update, the program will automatically apply this to the existing employee records wherever applicable.

Employee List Screen → HMRC → Download P6/P9 Tax Code Notifications

1.6 EMPLOYEE LIST - GENERATE LOGIN FOR EMPLOYEES

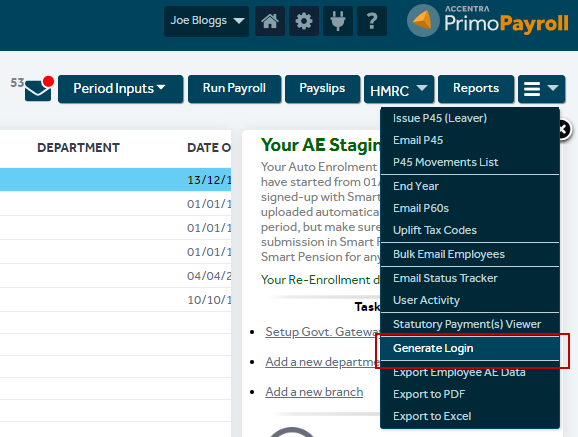

Bureau users (Enterprise edition) can now generate bulk employee login details for multiple employees at once.

Company → Employee List Screen → More → Generate Login

1.7 RTI - NO PAYMENT SUBMISSION

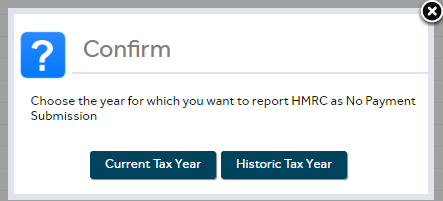

We've added a new option in the No Payment Submission so you can submit the NPS for historic tax years. You'll also be able to add the ‘Final FPS’ and ‘Scheme Cease Date’ in the No Payment Submission screen.

Employee List Screen → Payslips → RTI → No Payment Submission

1.8 PERIOD OF INACTIVITY

You can now add the ‘Final FPS’, ‘Scheme Ceased’ & ‘Scheme Ceased Date’ in the Period of Inactivity screen.

Employee List Screen → Payslips → RTI → Period of Inactivity

1.9 PAYROLL JOURNAL - YEAR SPECIFIC JOURNAL POSTING TO XERO

There's now an option to select the ‘Tax Year’ in the Payroll Journal Report so you can post journals to Xero for any period you wish.

Reports → Payroll Journal Posting

API Integration → Xero → Post Journals

Note: As there have been few design changes on the portal, please press (Ctrl + Shift + R) to update your cache to the latest version when you login to the portal if you’re experiencing continuous loading/freezing issues.