This article will guide you in making a Statutory Maternity Payment to your contractor in Primo Umbrella.

Manual SMP

If you wish to pay the SMP manually for a contractor, set the ‘Manual SMP’ under the HMRC tab in the contractor record to ‘Yes’. The user is required to calculate the SMP amount manually.

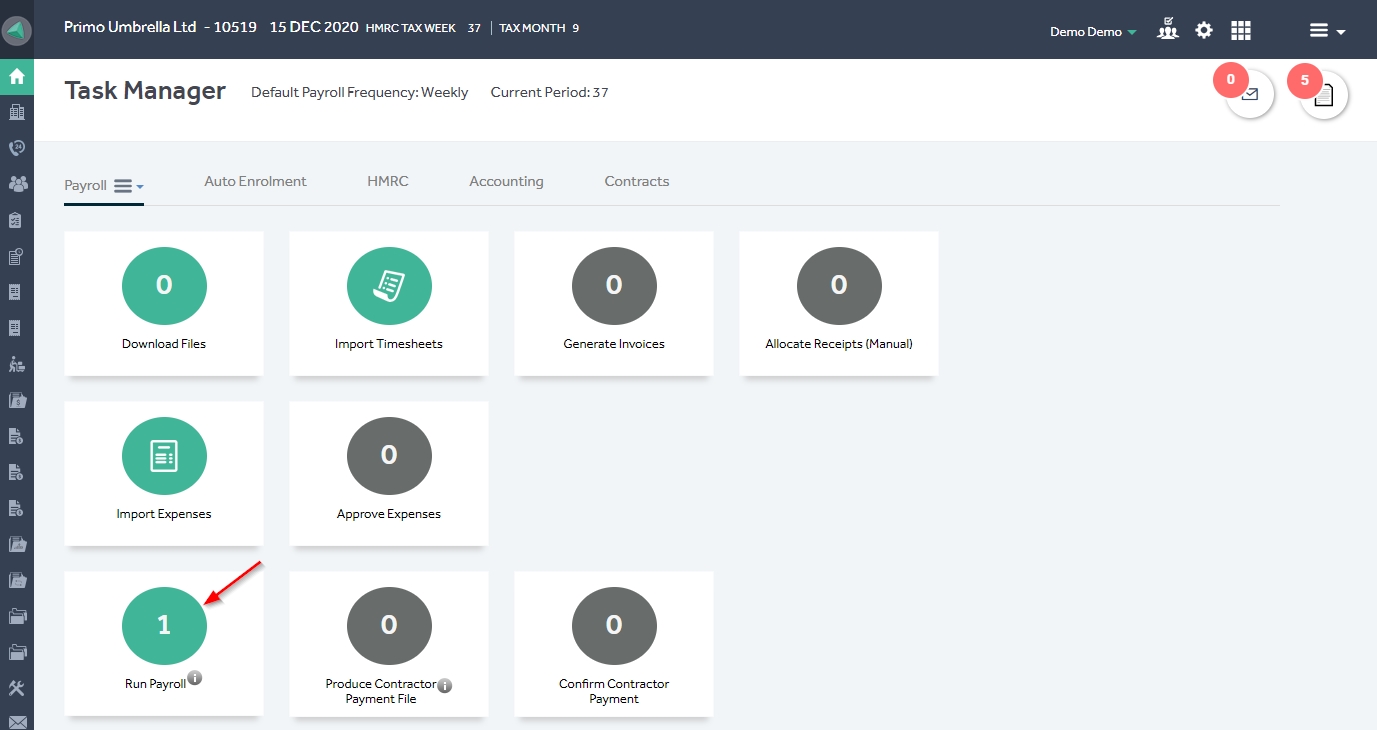

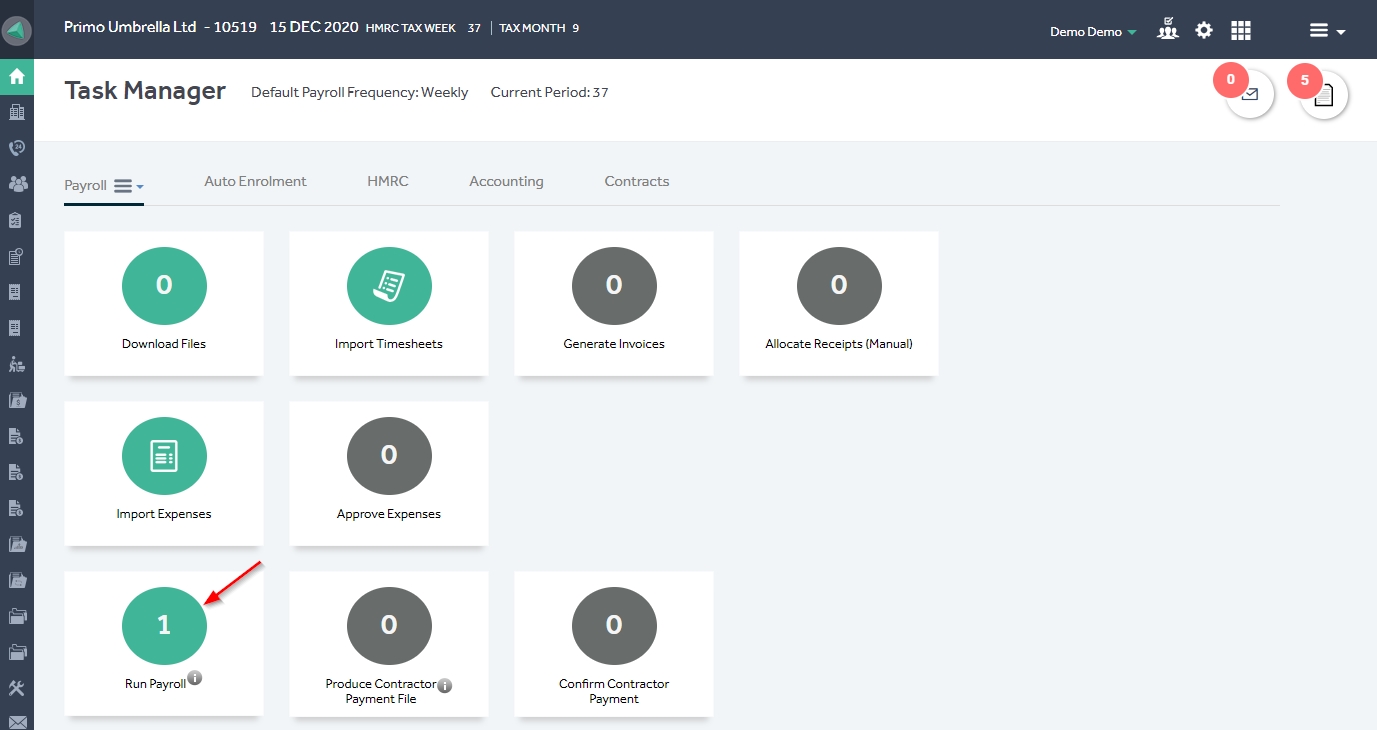

Step 1: Open the Task Manager.

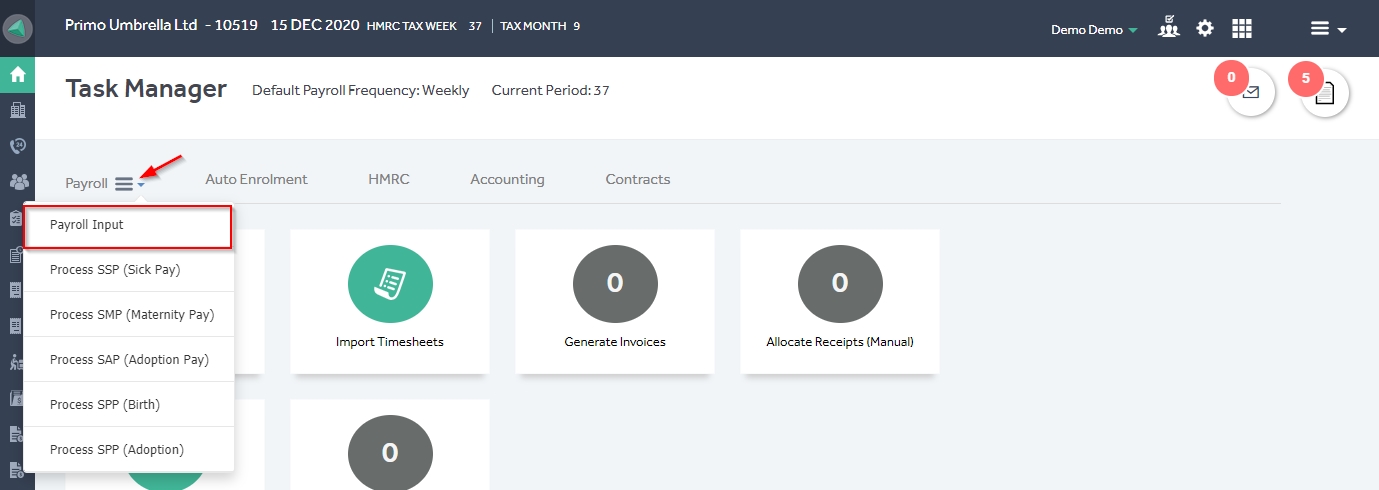

Step 2: Click the ‘Period Input’ from the ‘Payroll’ menu.

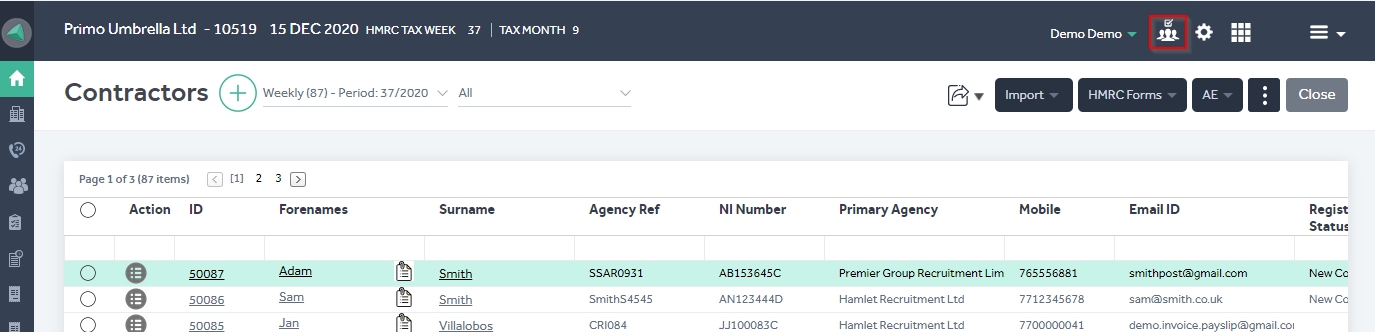

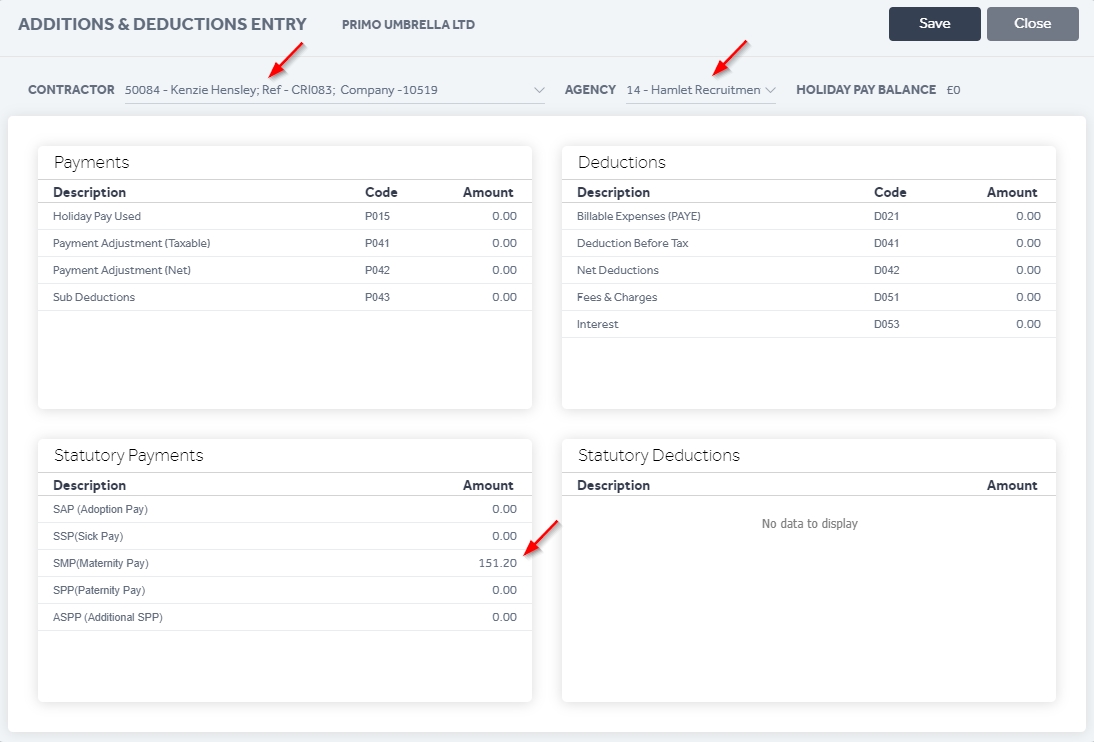

Step 3: Select the contractor for whom you wish to process the SMP (Select it manually from the dropdown or enter the name, Agency Reference or the Payroll Number). Enter the SMP amount in the ‘Statutory Payments’ section and click ‘Save’.

Step 4: The contractor will appear in the ‘Run Payroll’ section. You can run the payroll and view the payslip.

Automated SMP

If you wish to use the automated SMP for a contractor, set the ‘Manual SMP’ under the HMRC tab in the contractor record to ‘No’ and follow the steps below.

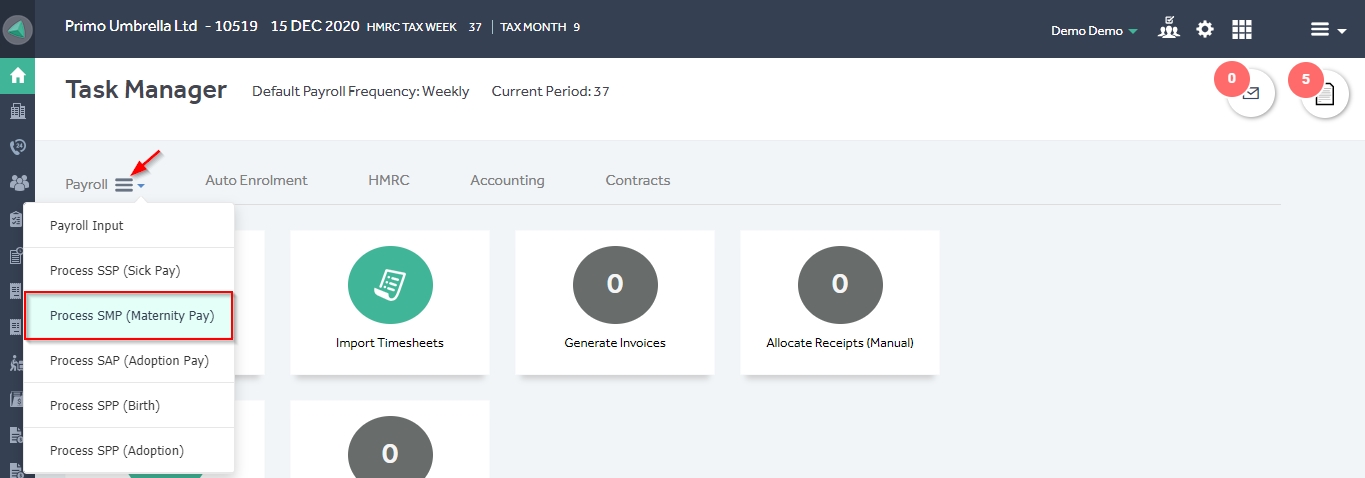

Step 1: Click the ‘Payroll’ menu dropdown in the Task Manager and click ‘Process SMP (Maternity Pay)’

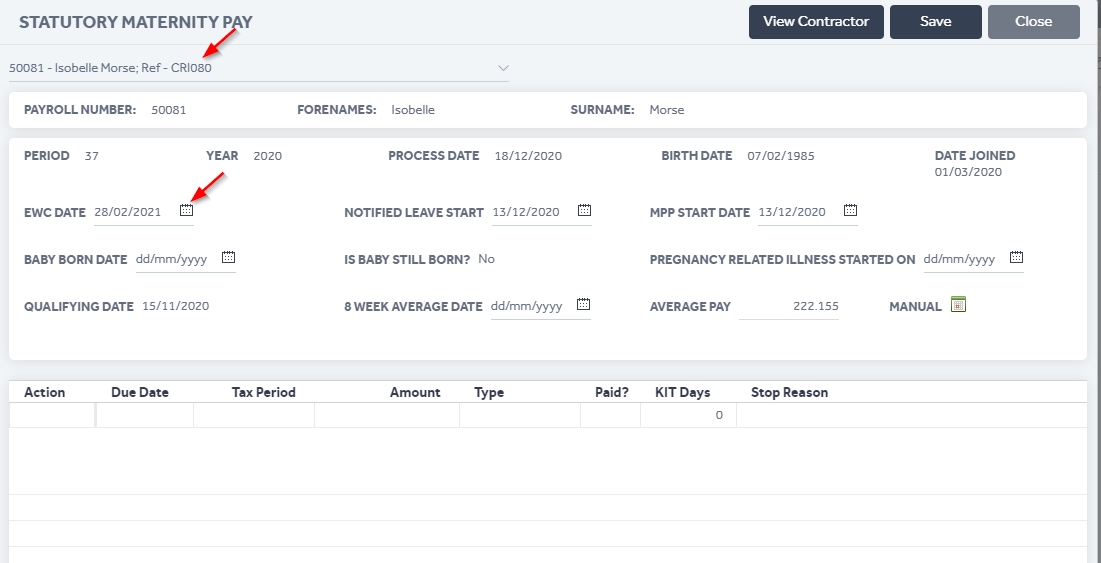

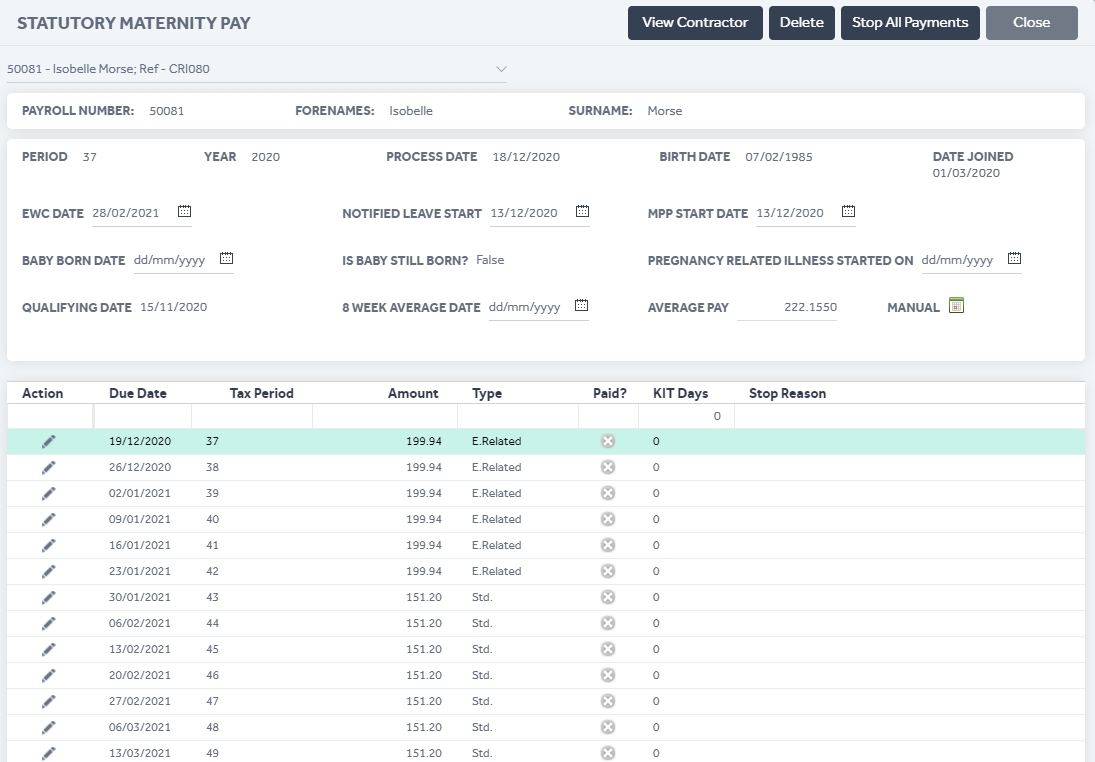

Step 2: Select the contractor you need to calculate the SMP for and enter the EWC (Expected Week of Childbirth) date. The system will automatically calculate the earliest maternity pay period (MPP) start date and the average pay. The program will allow you to amend the Notified Leave Start Date, MPP Start Date & the Average Pay as required. Click ‘Save’ to create an SMP Diary.

The software will calculate the SMP amount due for each pay period as shown below.

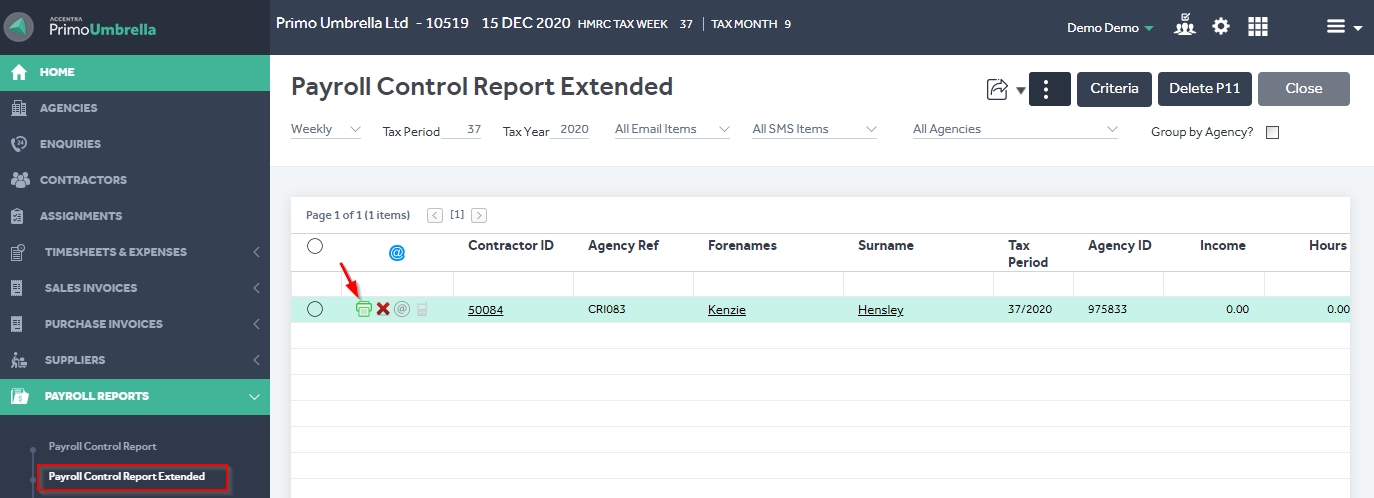

Step 3: The contractor will appear in the ‘Run Payroll’ section. Process the payroll and view the payslip from the Payroll Reports → Payroll Control Report/Extended