How to set up a pension scheme manually in Primo Payroll

You can add more pension schemes in Primo Payroll in addition to your auto enrolment pension scheme. You can either combine these pension contributions with the existing AE pension contributions to be sent to the pension provider (supported by Primo), or you can deduct these pension contributions separately.

1. Add a new pension scheme

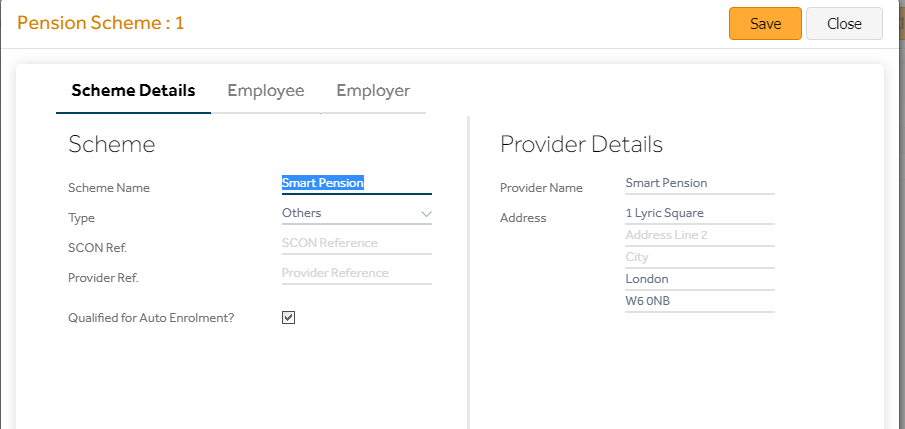

You can add a new pension scheme by going to Settings -> Pension Schemes -> Add New

| Field Name | Description |

| Scheme Details | Fill in the relevant Pension scheme details and the Pension Provider details |

| Qualified for Auto Enrolment? | Set this to “Yes” if you wish to include the pension contribution (deducted for this pension scheme) to be sent to the pension provider |

| Retirement Age | You don’t need to fill this as the age calculation for assessment is taken from the payroll table |

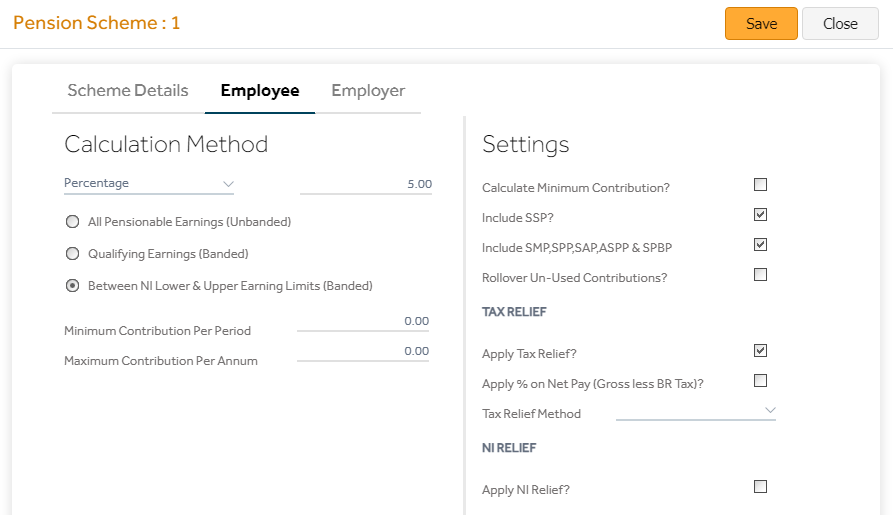

| Calculation Method | The method used to calculate the pension contributions |

| All Pensionable Earnings | Pension is calculated on all earnings marked as ‘Pensionable’ in Settings -> Payments |

| Between NI Lower & Upper Earning Limits | Pension is calculated only on the value between the NI lower & upper earning limits (Qualifying Earnings band) |

| Include SSP | The pension deduction will happen on the Statutory Sick pay |

| Include SMP, SPP & SAP | The pension deduction will happen on these Statutory Payments |

| Apply Tax Relief |

Tick this if you wish to deduct the pension before tax |

| Tax Relief Method: Relief by Employer |

Select this if the pension needs to be deducted before tax |

| Tax Relief Method: Relief by Pension Provider |

Select this if the pension needs to be deducted after tax (i.e. If the pension provider is getting the tax rebate on Pension from HMRC) |

| Apply NI Relief | Tick this if you wish to deduct the pension before NI (Salary Sacrifice) |

2. Employee Record Configuration

- When an employee is found to be an ‘Eligible Jobholder’ or when an employee Opts-in or Joins-in to the pension scheme, select from the Pension Scheme (you created in Step 1) from the dropdown and edit the Employee & Employer contributions if required.

- When an employee Opts-out or Ceases his active membership or when you wish to stop the pension, set the Pension Scheme to ‘Select’ Or set the Employee & Employer pension contributions to Zero.