This article will guide you in setting up your payroll company processing rules.

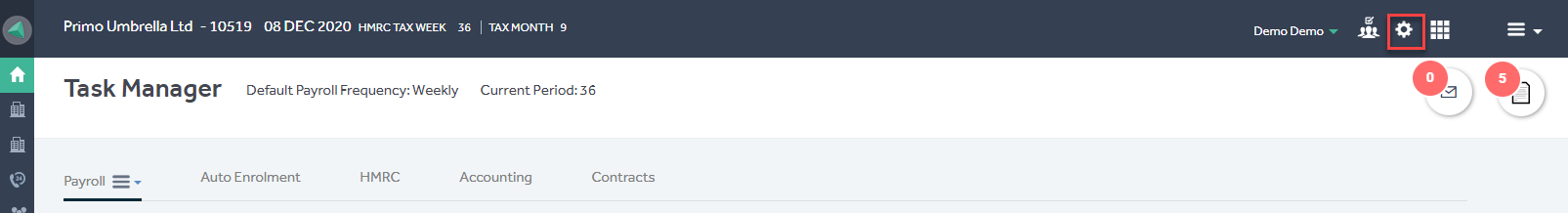

Settings

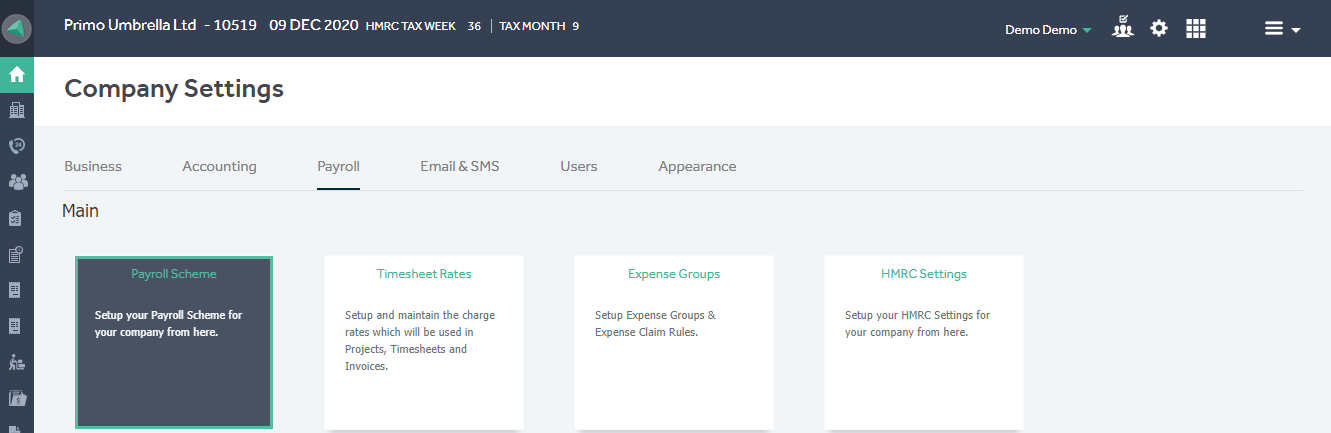

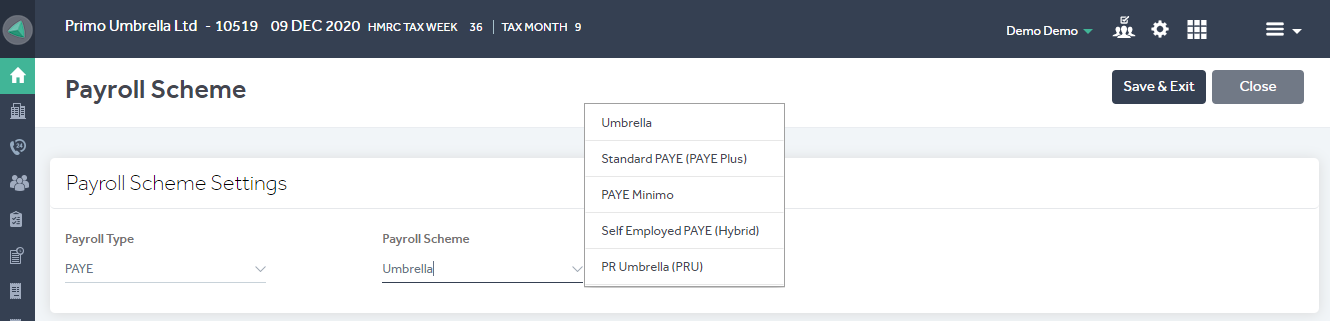

Payroll Scheme

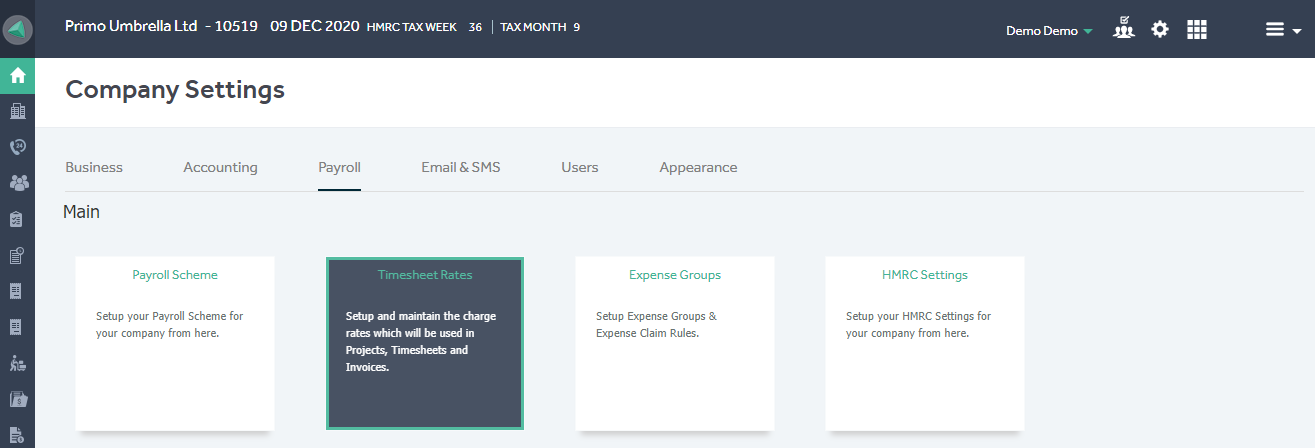

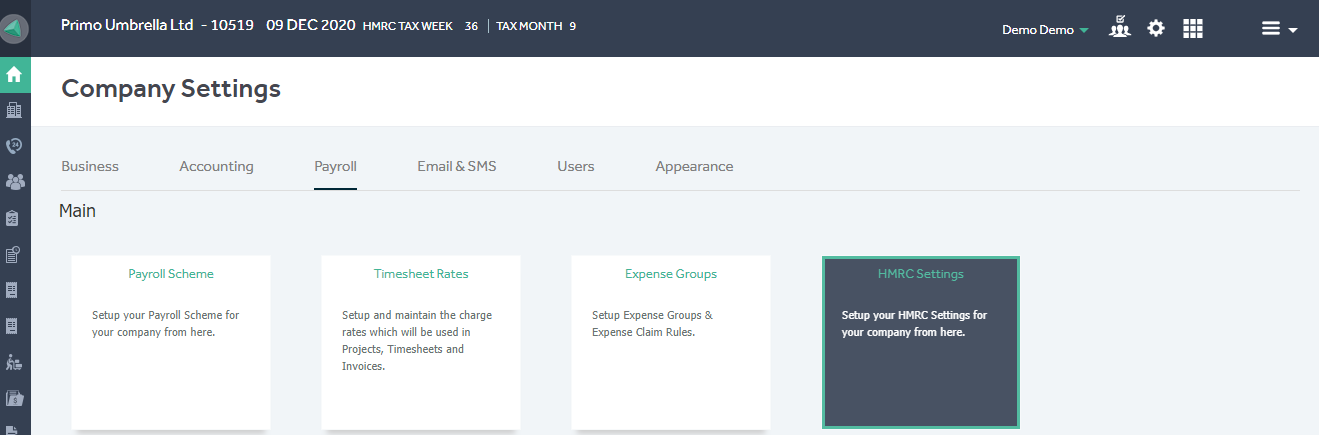

Step 1: Click the ‘Settings  ’ icon on the right top corner and click the ‘Payroll’ tab.

’ icon on the right top corner and click the ‘Payroll’ tab.

Step 2: Click the ‘Payroll Scheme’.

Payroll Tab > Main > Payroll Scheme

Step 3: Select your Payroll type required. Primo Umbrella also supports other models such as Self-Employed CIS, Non-CIS and the Joint Employment model.

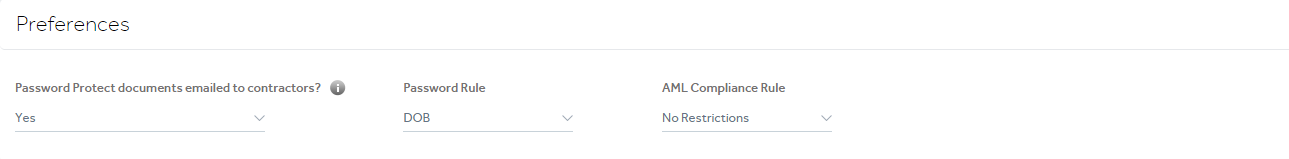

Step 4: You can password protect the payslips and the documents you send from the software, as well as set your Anti-money laundering (AML) compliance rules.

Timesheet Rates

Step 1: Open the ‘Timesheet Rates’ section in the ‘Payroll’ tab.

Payroll Tab > Main > Timesheet Rates

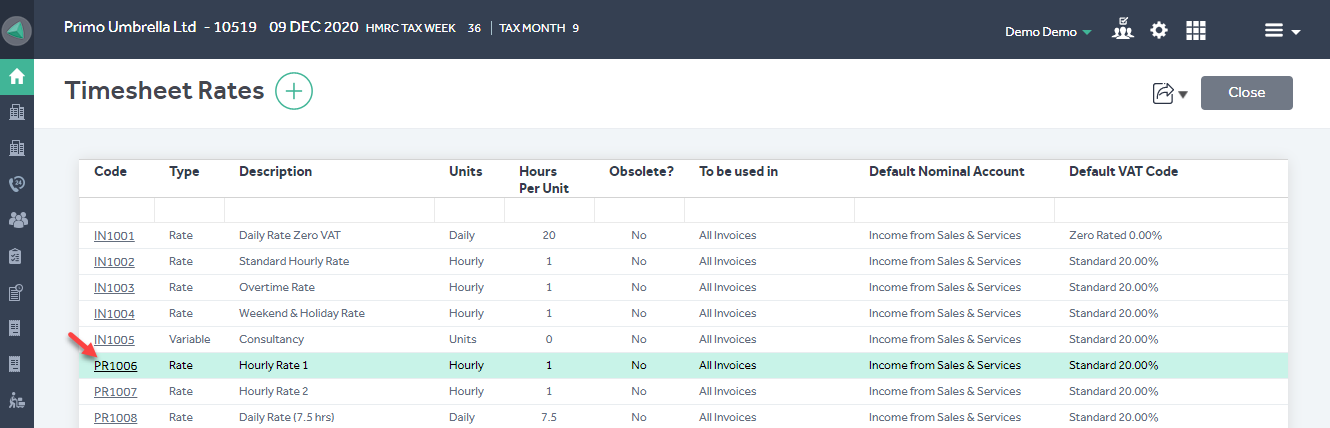

Step 2: You can add new timesheet rates by clicking the  button or amend the existing ones by clicking the corresponding code. If you wish to add a new rate in your timesheet import template, kindly send us a request to our support team on support@accenta.co.uk and we will link it to the Timesheet import template.

button or amend the existing ones by clicking the corresponding code. If you wish to add a new rate in your timesheet import template, kindly send us a request to our support team on support@accenta.co.uk and we will link it to the Timesheet import template.

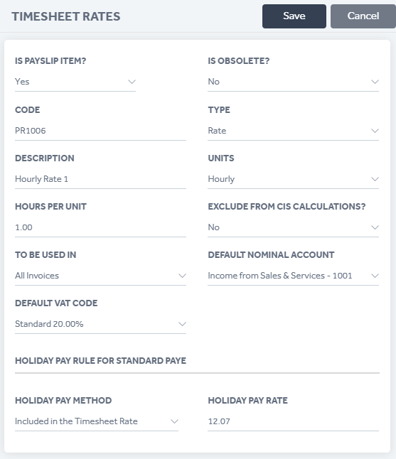

Timesheet Rate settings

| Setting | Description |

| Is Payslip item? | set whether this rate is related to contractor payment or not |

| Is Obsolete? | set to ‘Yes’ if you do not wish to use this payment rate any more |

| Type | the type dictates how this timesheet rate can be imported (e.g. for the ‘Rate’ type, you will require to provide a unit quantity, and the ‘Fixed’ type will require only the amount) |

| Description | set how this rate should appear on the invoices. |

| Units | set the number of hours per unit (Hourly, Daily, Weekly, Monthly etc.) |

| To be used in | set to what items this rate applies to (All invoices, Expense bills etc.) |

| Default VAT Code | set the VAT rate applicable to this rate |

| Holiday Pay Method and Rate | set whether Holiday Pay is applicable to this rate |

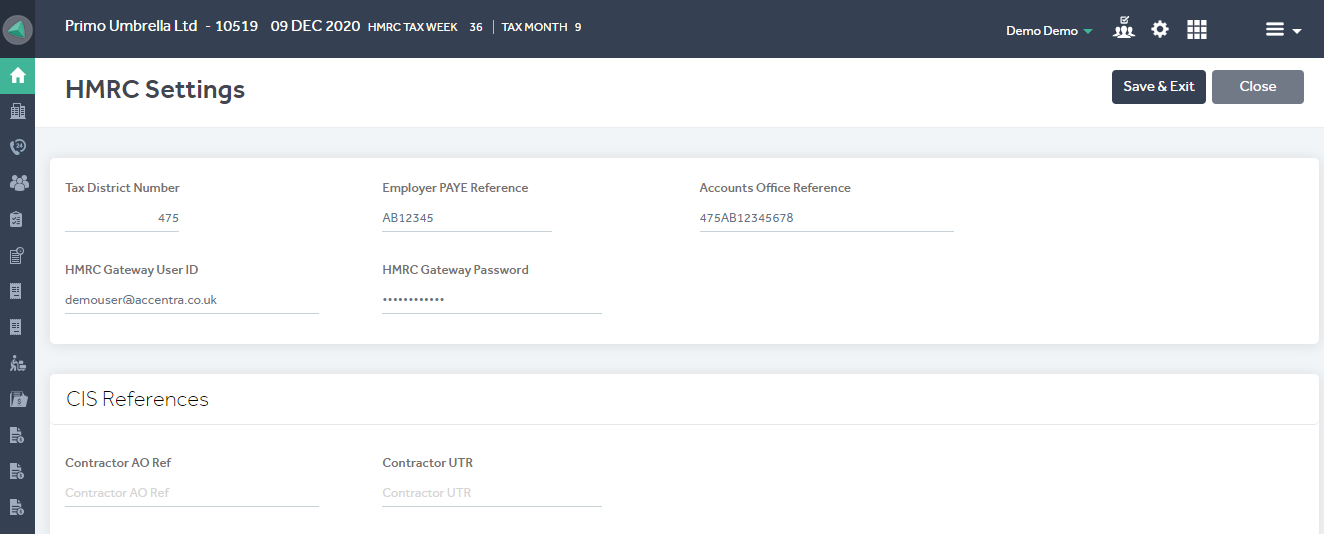

HMRC Settings

Step 1: Click the ‘HMRC Settings’ section in the ‘Payroll’ tab.

Payroll Tab > Main > HMRC Settings

You will be able to input your company details as well as the HMRC gateway user ID and password for RTI submissions. Once all the necessary fields are completed click ‘Save and Exit’. Additional references for CIS Company is also available in this screen.