This article will guide you in setting up the PAYE Settings in Primo Umbrella.

PAYE Main Settings

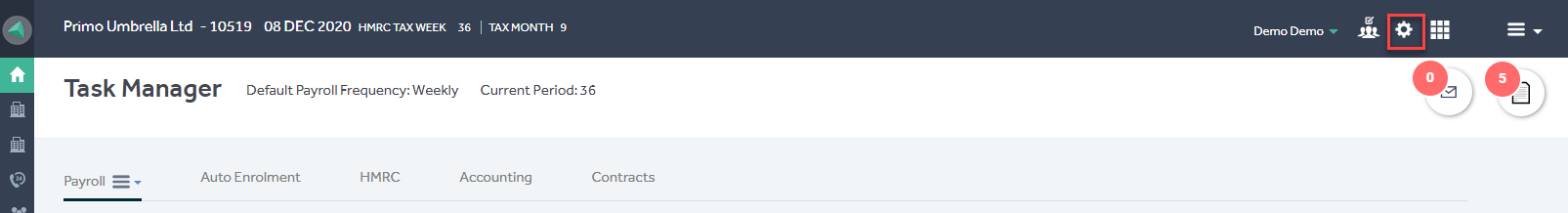

Step 1: Click the ‘Settings  ’ icon.

’ icon.

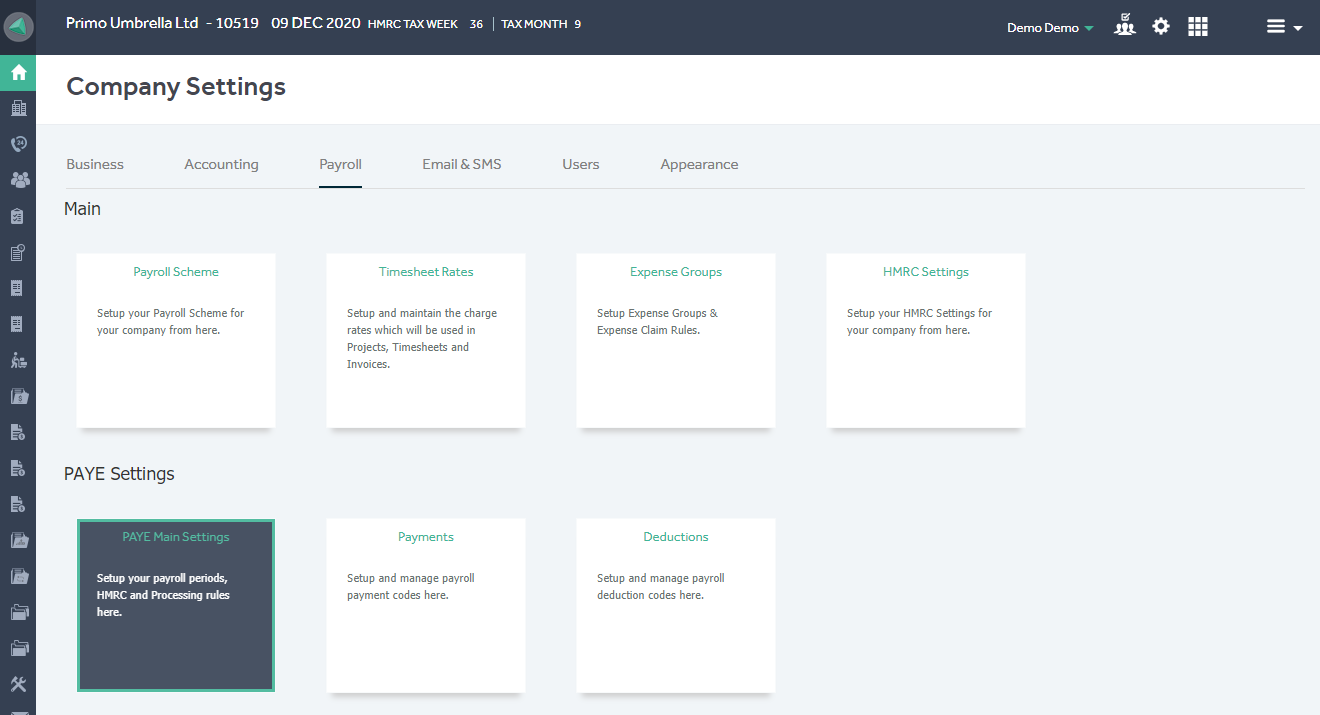

Step 2: Click the ‘PAYE Main Settings’ in the ‘Payroll’ tab.

Payroll Tab → PAYE Settings → PAYE Main Settings

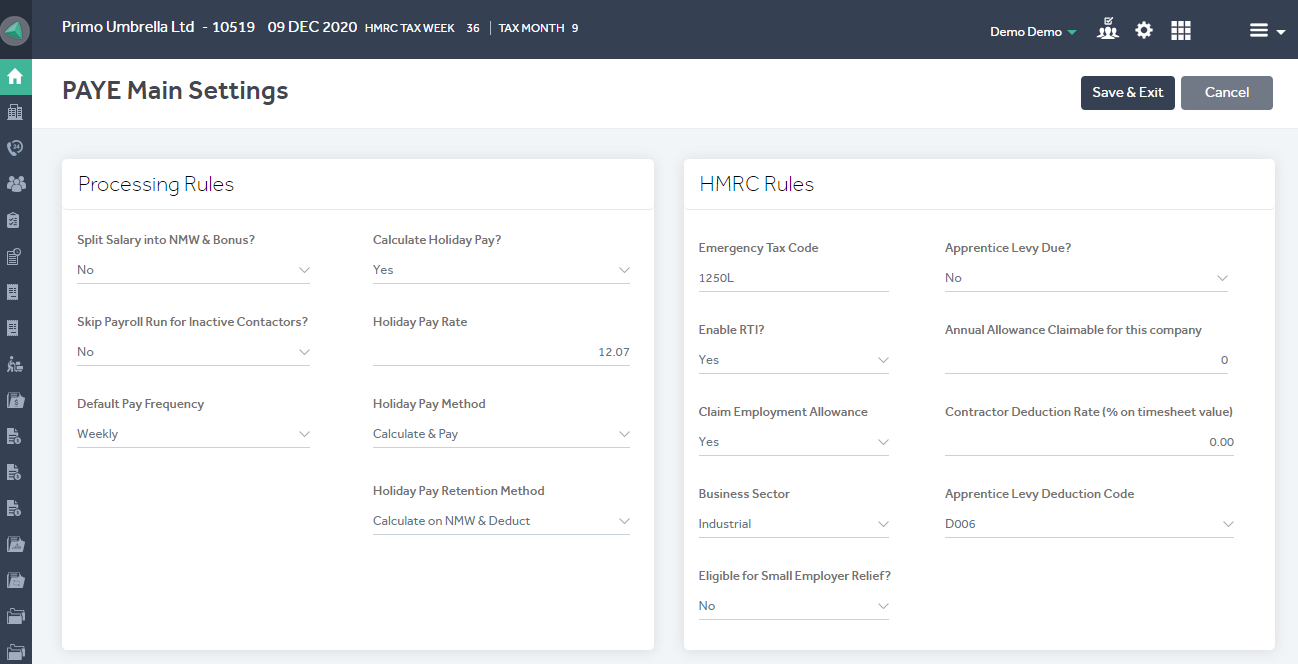

Processing Rules

| Rule | Description |

| Split Salary into NMW and Bonus? | Set this to Yes if you wish to split the NMW & Bonus to be shown separately on the payslip. |

| Calculate Holiday Pay? | Set this to Yes if you wish to calculate Holiday Pay |

| Holiday Pay Rate | Mention the holiday pay percentage |

| Holiday Pay Method | Set the default Holiday Pay method for your company |

| Holiday Pay Retention Method | Select the basis on which Holiday Pay is calculated and deducted (on NMW rate or All earnings) |

HMRC Rules

| Rule | Description |

| Emergency Tax Code | This will be the default Tax Code to be used for new contractors |

| Apprentice Levy Due | Set whether Apprentice Levy should be deducted or not |

| Annual Allowance Claimable for this company | The amount of Employment Allowance claimable from the HMRC for this tax year |

| Claim Employment Allowance | If you wish to claim the employment allowance. |

| Business Sector | Select the appropriate business sector of your company |

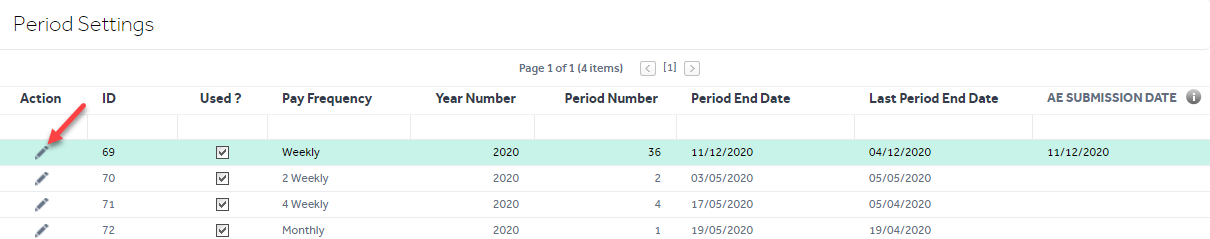

Period Settings

The Period Settings can be amended by clicking the ‘Edit’ icon in the Action column. You can activate the payroll frequency which you use and set the current period’s end date. You can either align it to tax calendar or weekly calendar. If you’re integrated with a pension provider to automatically upload the pension contributions, then you should set the AE Submission Date (end date of the pension file the pension provider is expecting).

Click  to apply the changes.

to apply the changes.

Once you have made all the amendments, click ‘Save & Exit’.