This article will guide you in issuing a P45 to an employee, report them to the HMRC and email the P45 to the employees.

Marking an employee as a leaver

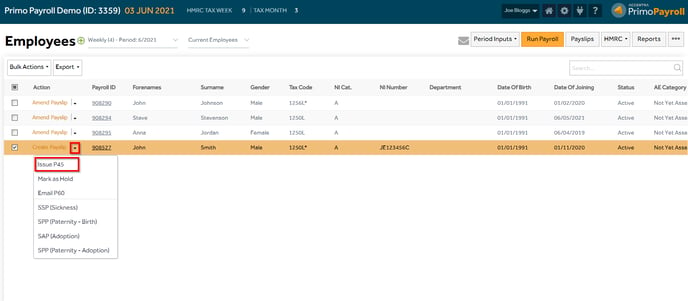

Step 1: From the Employee List screen, select the required employees and from the ‘More’ options, click ‘Issue P45 (Leaver)’.

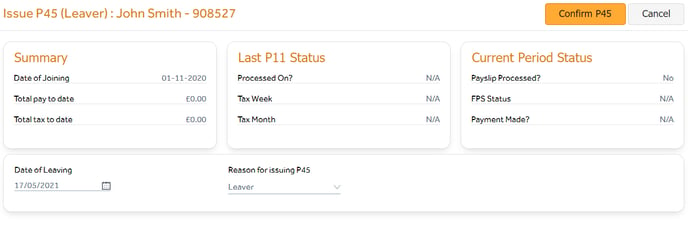

Step 2: Fill in the leaving date and leaver reason and click ‘Confirm P45’.

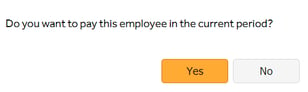

Step 3: The program will ask if you wish to pay the employee in the current period or not.

A) Yes – the employee will be marked a ‘Leaver’ after closing the current period.

B) No – the record will be marked as ‘Leaver’ immediately.

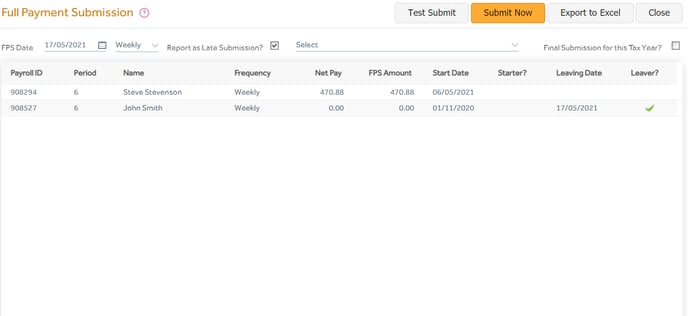

Leaver FPS Submission

The employee who has been issued a P45 will be populated automatically on the FPS submission screen to be reported to the HMRC.

Emailing the P45 form

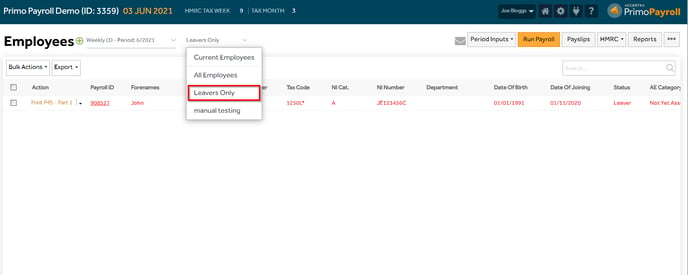

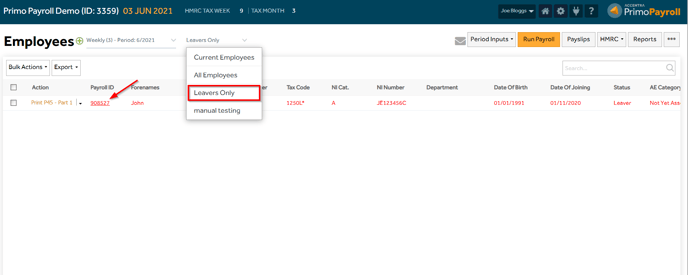

Step 1: Once you have processed all due payments to your employee, you can issue the P45 form. Select ‘Leavers Only’ in the ‘Employees’ filter and select the employees you wish to send the P45 form.

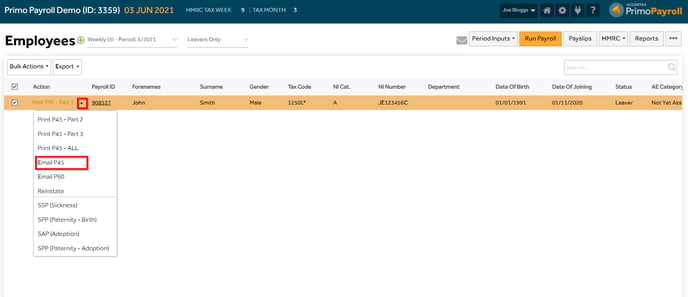

Step 2: Click ‘Email P45’ in the ‘More’ options to send the P45 to the selected employees.

Downloading the P45

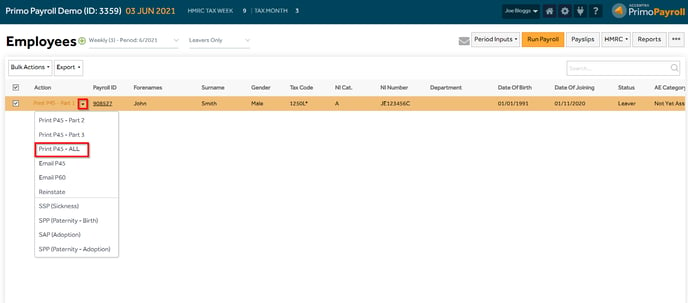

Step 1: Select ‘Leavers Only’ in the filter dropdown on the Employee List Screen and open the leaver record for whom you wish to download the P45 form.

Step 2: Open the ‘More ’ menu and click ‘Print P45 – ALL’ to open and download all parts of the P45 form. If you wish to download only a certain part, you can do so by clicking the relevant option available.