The below steps will guide you through rolling back to a previous period and resubmitting FPS.

Period Rollback

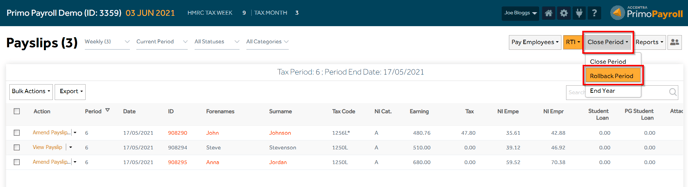

Step 1: Go to the ‘Payslips’ screen by clicking the 'P11 List' button as highlighted below.

Step 2: Click the ‘More’ options and select ‘Rollback Period’.

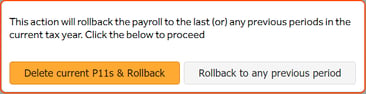

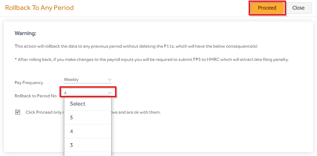

A pop-up window will appear asking whether you wish to roll back to the last period or any previous period in the current tax year. Select the required option.

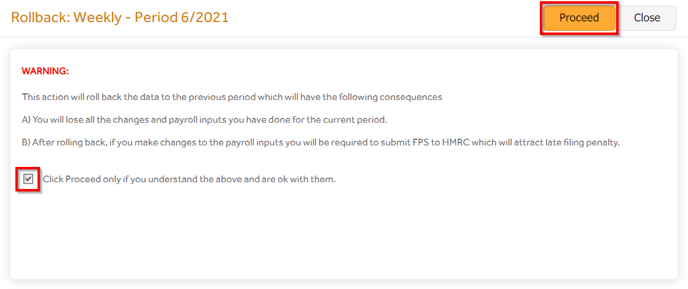

Note that late filing of FPS may result in a penalty. If you still wish to proceed with the rollback, tick the checkbox and click ‘Proceed’.

-

Delete current P11 & Rollback:

Any data entered in the current period will be lost.

You will receive a confirmation message that the period has been rolled back successfully.

-

Rollback to any previous period:

If you wish to rollback to any previous period, you will be asked to specify the exact period and pay frequency you wish to roll back.

After making amendments to the period, kindly resubmit the FPS and proceed to close period. You will be prompted to select the period you wish to roll forward to. After selecting the period number, click ‘Proceed’ to move to the selected period.

You will receive a confirmation pop-up message that the period has been rolled forward successfully.

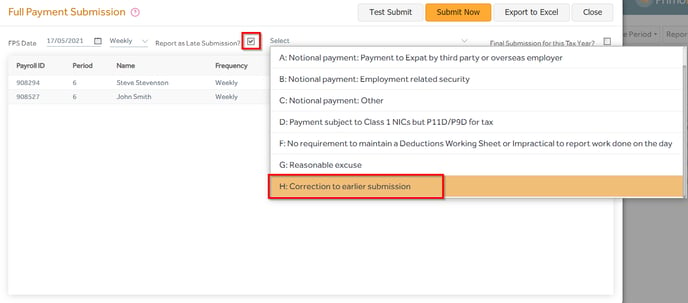

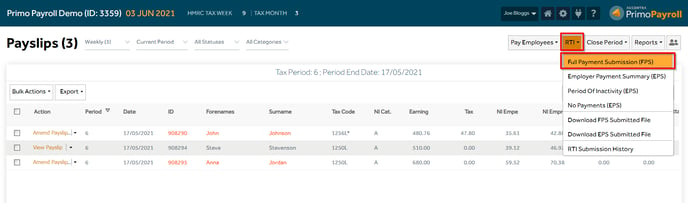

FPS Resubmission

Step 1: Once you have made the payroll amendments, you’ll need to resubmit the FPS to the HMRC.

Payslips screen → RTI dropdown → Full Payment Submission (FPS).

Step 2: Tick the ‘Report as Late Submission?’ checkbox and select the late filing reason as ‘H – Correction to earlier submission’ and click ‘Submit Now’. Once you’ve submitted the FPS, you can close the period.