This article will guide you through the process of setting up furlough payment processing for a contractor

You will need to manually calculate the claim amount for each employee, depending on whether they are full-time or flexibly furloughed.

Follow the recent HMRC guidelines on the calculation.

Processing furlough payments in the software

General

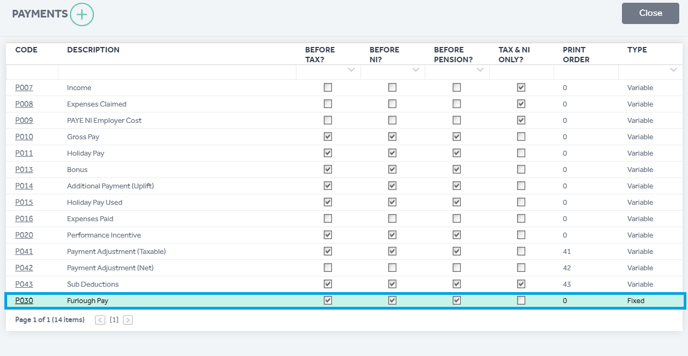

Step 1: Make sure a new Payment code P030 appears on the Payment Codes list, with the following parameters. If it doesn’t, contact our support team for assistance.

Settings → Payroll (tab) → PAYE Settings → Payments

|

Code |

Description |

Type |

Before Tax |

Before NI |

Before Pension |

Tax & NI Only |

|

P030 |

Furlough Pay |

Fixed |

Yes |

Yes |

Yes |

No |

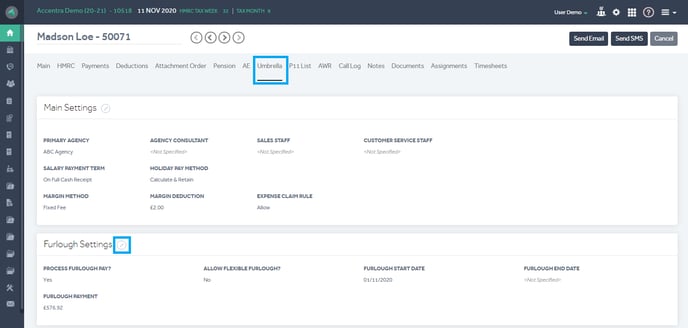

Step 2: Enable the contractor for furlough

Contractor Record → Umbrella (tab) → Furlough Settings

- Process Furlough Pay? → Yes

- Fill in the furlough pay start date

- Save the changes.

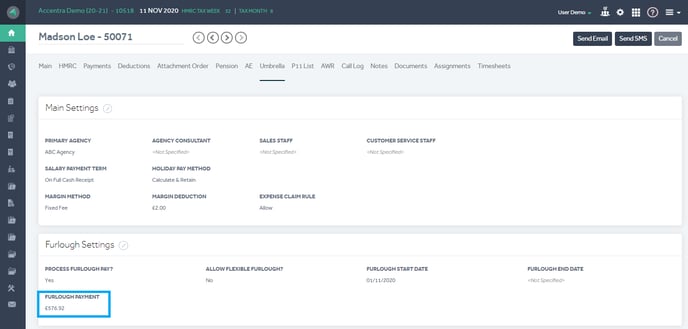

Full-time furlough

Once you have enabled the contractor for furlough payments, calculate the furlough pay and enter the amount on the relevant contractor record.

Contractor Record → Umbrella (tab) → Furlough Settings

- Enter the calulated amount on 'Furlough Payment'

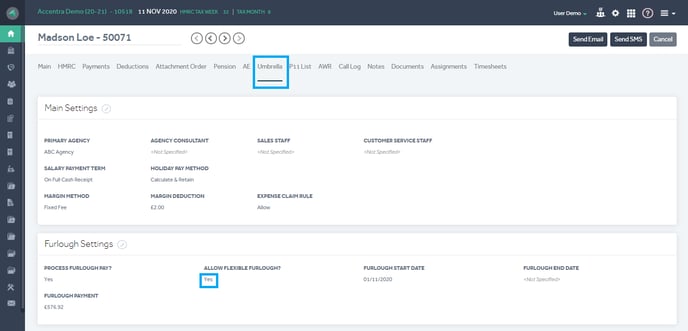

Flexible Furlough

Step 1: Enable the contractor for flexible furlough pay

Contractor Record → Umbrella (tab) → Furlough Settings

- 'Allow Flexible Furlough?': Yes

- Enter the calulated amount on 'Furlough Payment'

Processing Payroll

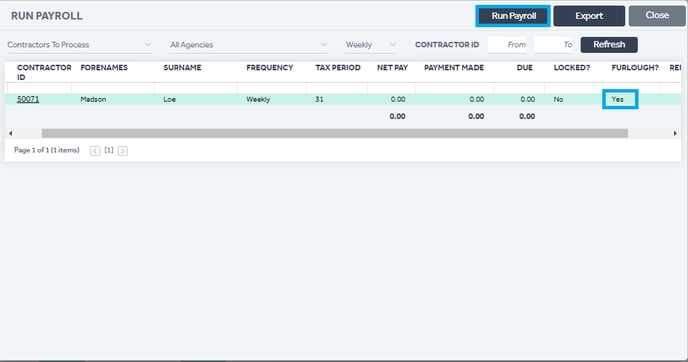

The records marked for furlough pay processing will be shown on the ‘Run Payroll’.

Note: You can only process timesheets for furloughed contractors who are on Flexible Furlough.