This article will help you set the appropriate period number if the current one is incorrect.

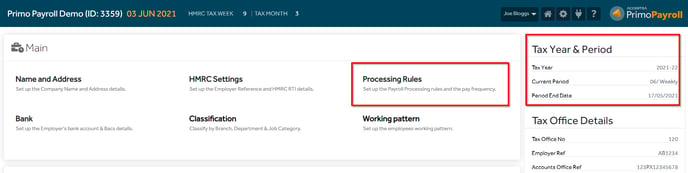

Step 1: Click on  in the upper right corner.

in the upper right corner.

Step 2: Click on the “Processing Rules” button in the Main section. On the right side of this screen, you are able to see the current Tax year and period settings.

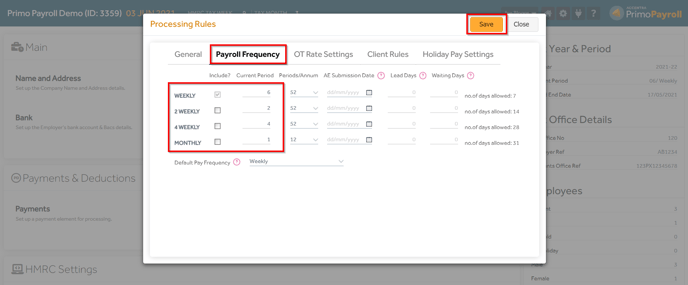

Step 3: Go to the “Payroll frequency” section in the Processing Rules screen. You will be able to change your current period number for each frequency. The period end date will automatically follow the HMRC calendar end date for the respective period. Note: This option is only applicable if no periods have been closed prior to this.

Step 4: After amending the period number click the “Save” button. A pop-up message will appear confirming that the settings have been updated.