This article will guide you in submitting the Full Payment Submission (FPS) to the HMRC from Primo Payroll.

RTI Settings

To make a Full Payment Submission, you’re required to enable the RTI and fill-in the Employer PAYE reference & the Accounts office reference in the HMRC Settings. Click here to see how to do this.

Full Payment Submission

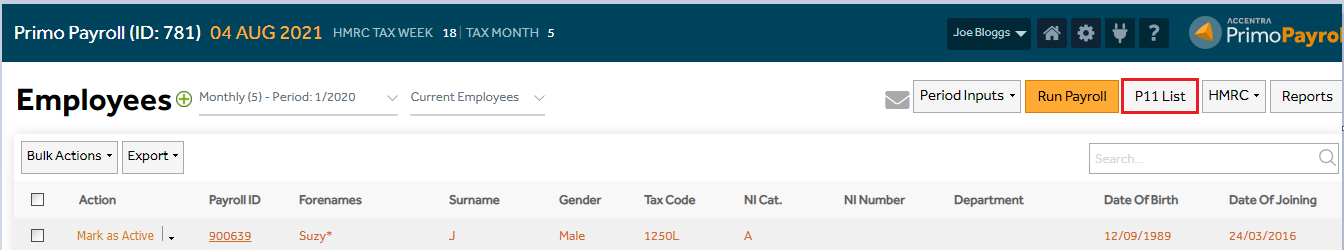

Step 1: Click the ‘P11 list’ button.

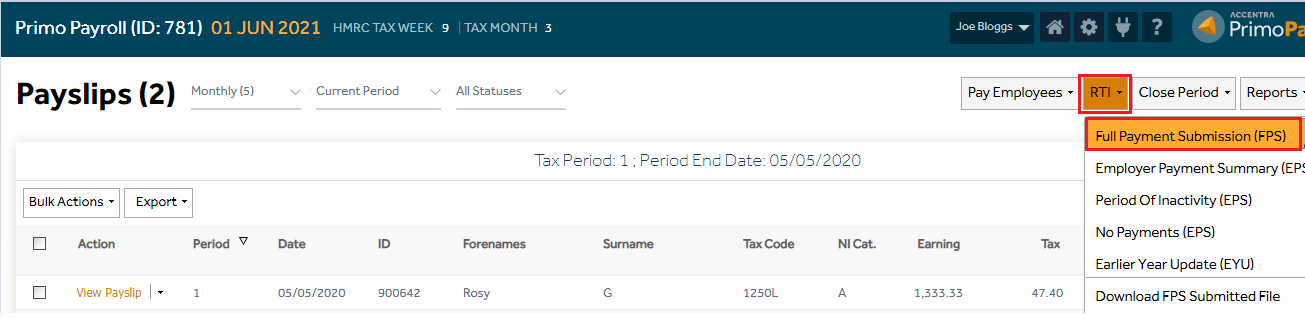

Step 2: Under the ‘RTI’ menu, click the ‘Full Payment Submission (FPS)’.

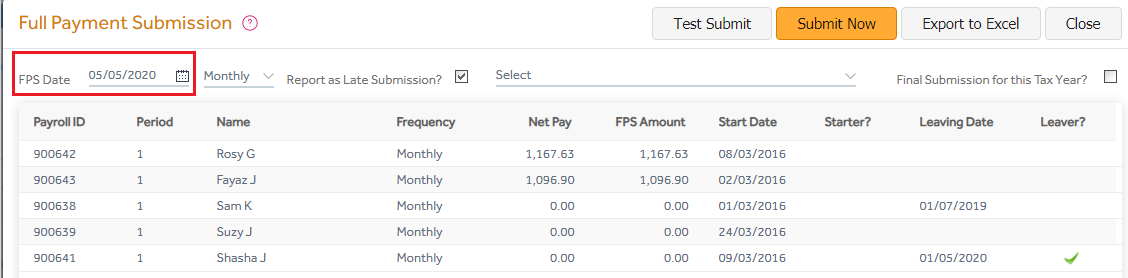

Step 3: The FPS screen will list the items to be submitted to the HMRC. The FPS Date in this screen is set to the current period’s end date by default. If you wish to report a specific ‘Payment Date’ to the HMRC, you need to change this to the appropriate date.

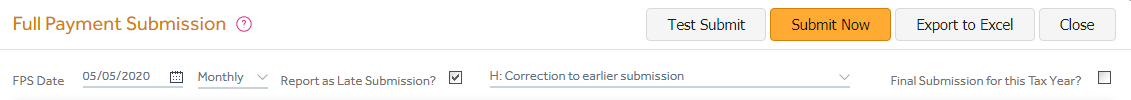

Also, select the required ‘Pay Frequency’ from this dropdown and if this is a late FPS submission, tick the ‘Report as Late Submission’ box and select the late submission reason from the dropdown. And, if this FPS is the final submission for this tax year, tick the ‘Final Submission for this tax year’ box and then click ‘Submit Now’. This will submit the FPS to the HMRC and the program will display an acknowledgement message.