This article will guide you in submitting the Employer Payment Summary (EPS) to the HMRC in Primo Umbrella

RTI Settings

To make a Full Payment Submission, you’re required to enable the RTI and fill-in the Employer PAYE reference & the Accounts office reference in the HMRC Settings. Click here to see how to do this.

EPS Submission

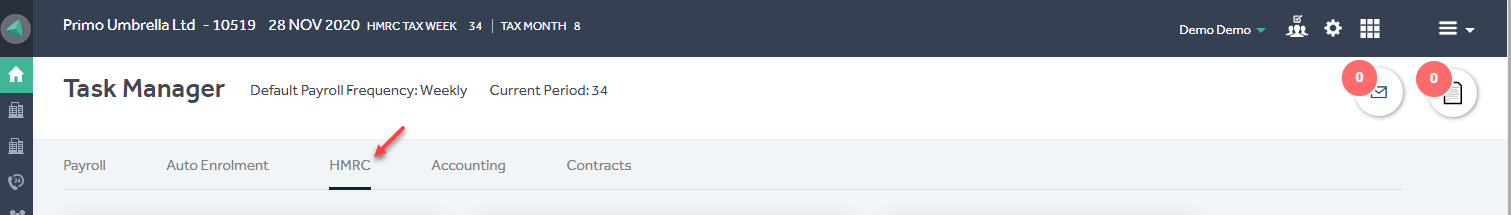

Step 1: Click the ‘HMRC’ tab from the Task Manager screen.

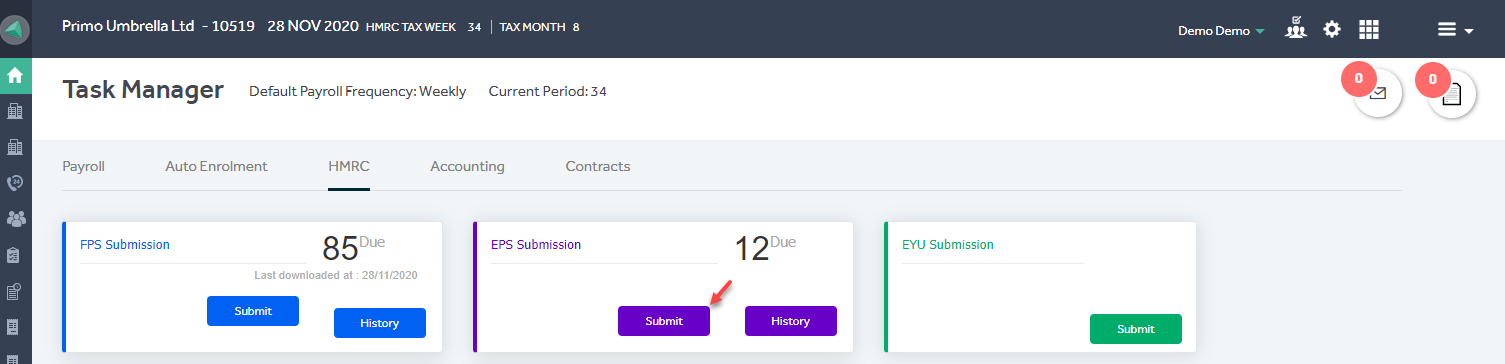

Step 2: Click ‘Submit’ to open up the EPS submission screen.

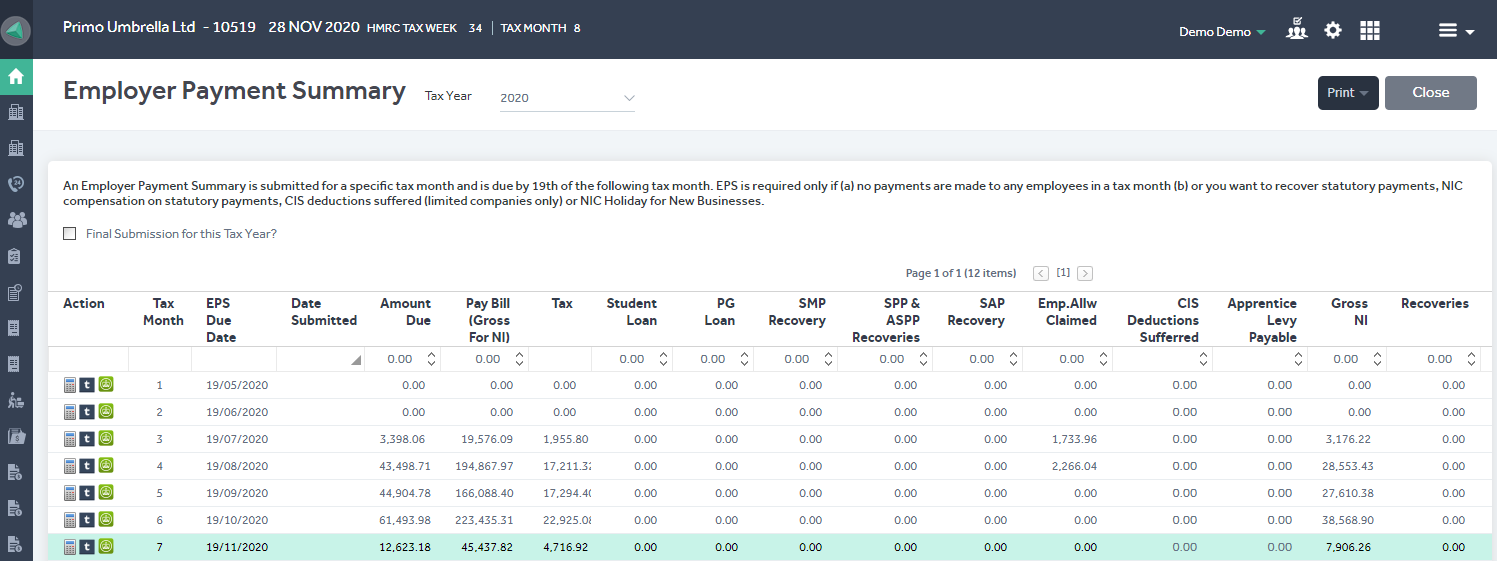

Step 3: Click the ‘Calculate  ’ icon for the respective month you wish to make the submission for and the program will calculate the EPS figures. If this is your last EPS submission of the current tax year, tick the ‘Final submission of this Tax Year’. If you’re OK with the figures populated on the EPS screen, click the ‘Submit

’ icon for the respective month you wish to make the submission for and the program will calculate the EPS figures. If this is your last EPS submission of the current tax year, tick the ‘Final submission of this Tax Year’. If you’re OK with the figures populated on the EPS screen, click the ‘Submit  ’ icon. This will submit the EPS to the HMRC and the program will display an acknowledgement message.

’ icon. This will submit the EPS to the HMRC and the program will display an acknowledgement message.

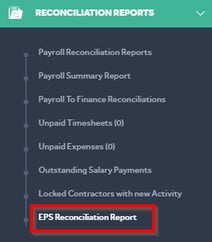

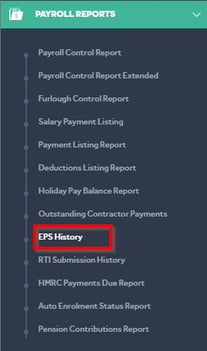

The EPS submission History and Reconciliation report can be accessed from the main menu as shown below.

Main Menu → Payroll Reports → EPS History

Main Menu → Reconciliation Reports → EPS Reconciliation Report