This article will guide you in submitting the Employer Payment Summary (EPS), Period of Inactivity (EPS) & No Payment information (EPS) to the HMRC from Primo Payroll.

RTI Settings

To make an Employer Payment Summary, you’re required to enable the RTI and fill in the Employer PAYE reference & the Accounts office reference in the HMRC Settings. Click here to see how to do this.

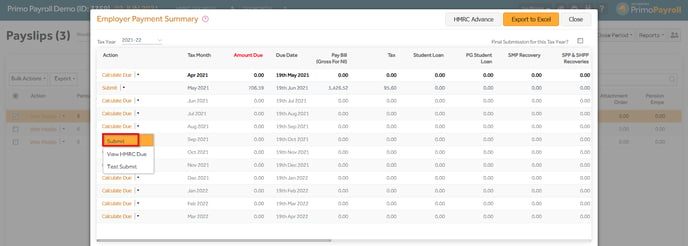

Employer Payment Summary (EPS)

Step 1: Click the ‘P11’ button.

Step 2: Under the ‘RTI’ menu, click the ‘Submit EPS’.

Step 3: Click the ‘Calculate’ for the respective month you wish to make the submission for and the program will calculate the EPS figures. If this is your last EPS submission of the current tax year, then select the ‘Final submission of this Tax Year’. If you’re OK with the figures populated on the EPS screen, click the ‘Submit’. This will submit the EPS to the HMRC and the program will display an acknowledgment message.

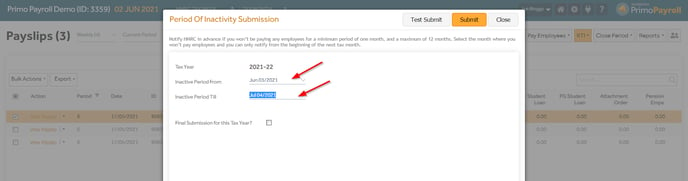

Period of Inactivity (EPS)

If you wish to report a Period of Inactivity for the upcoming months, then from the RTI dropdown, click the ‘Submit Period of Inactivity’ EPS and select the periods of inactivity and click Submit.

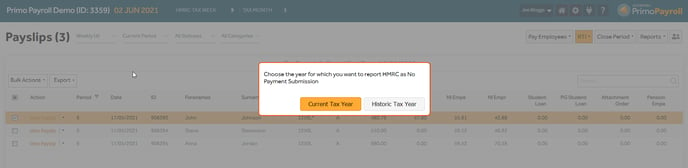

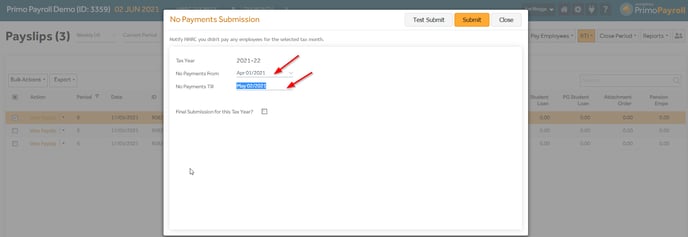

No Payment Information (EPS)

If you wish to report a Submit No Payment Information EPS for the past months in the current or historic tax year, click the ‘Submit No Payment Information EPS’ and select the periods of No Payments, and click Submit.