This article will help you in understanding the ‘HMRC Tasks’ notifications for Bureau users in Primo Payroll.

HMRC Tasks

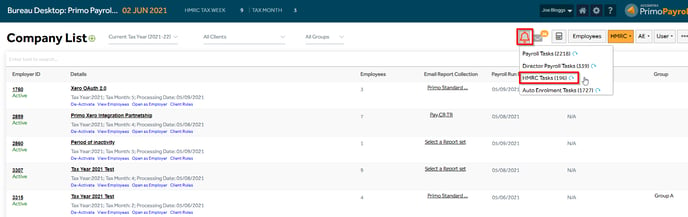

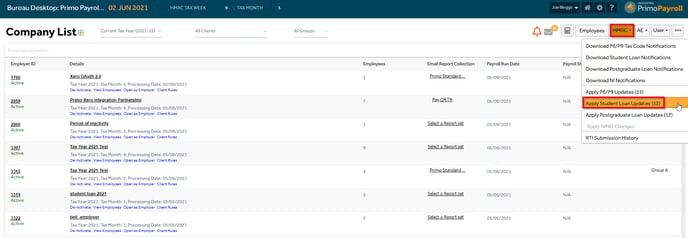

Step 1: From the ‘Company List’ screen, click the ‘Notifications (Bell Icon)’ and then ‘HMRC Tasks’.

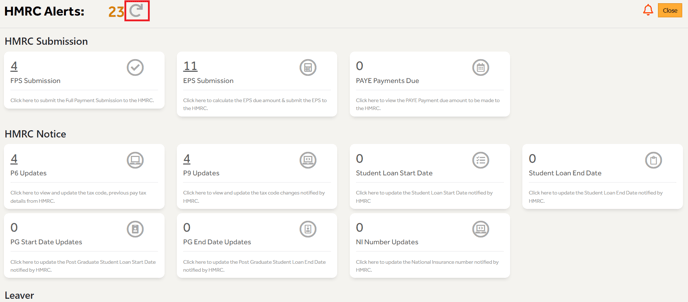

Step 2: Click the ‘Refresh’ icon to update the outstanding tasks to be done.

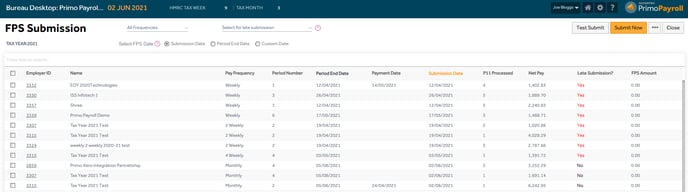

FPS Submission

The user can perform a bulk FPS submission from this screen. Select the Pay Frequency, FPS date and the ‘Late filing reason’ (if applicable) and click ‘Submit Now’.

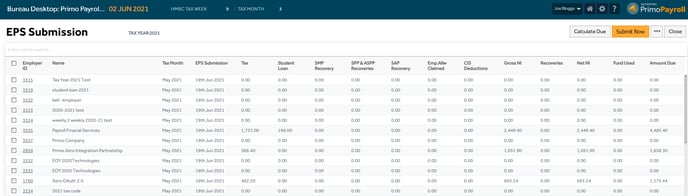

EPS Due Date

Complete the clients’ outstanding Employment Payment Summary in bulk from this page. Select the required company and click the ‘Calculate Due’ button. The program will calculate the HMRC due and display it on the screen. Check the values on the screen and then click the ‘Submit Now’ button to send the EPS to the HMRC.

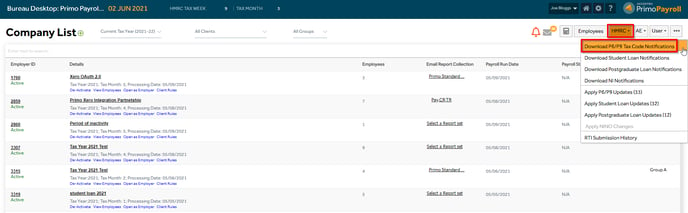

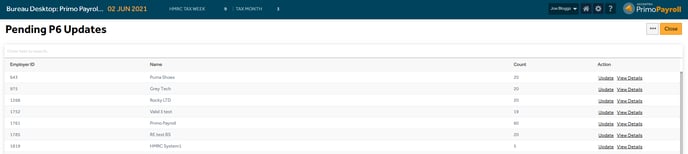

P6/P9 Updates

The user can download the tax code notices received from HMRC by clicking the ‘Download P6/P9 Tax Code Notifications’ under the HMRC dropdown. Once downloaded, the information can be viewed and the employee record can be updated by clicking the ‘Update’ button.

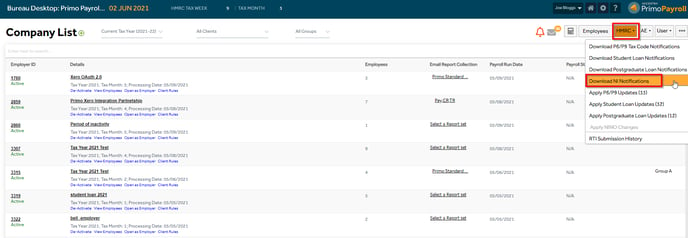

NI Number Updates

The user can download the NI Number update received from HMRC by clicking the ‘Download NI Notifications’ under the HMRC dropdown. Once downloaded, the information can be viewed and the employee record can be updated by clicking the ‘Update’ button.

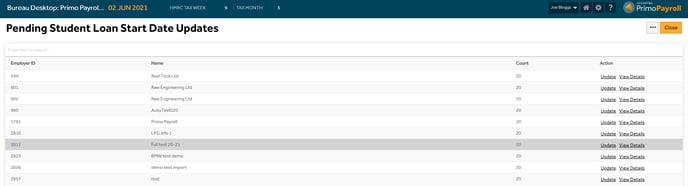

Student/Postgraduate Loan Updates

The user can download the Student and Postgraduate Loan updates received from HMRC by clicking the ‘Download Student/Postgraduate Loan Notifications’ under the HMRC dropdown. Once downloaded, the information can be viewed and the employee record can be updated by clicking the ‘Update’ button.

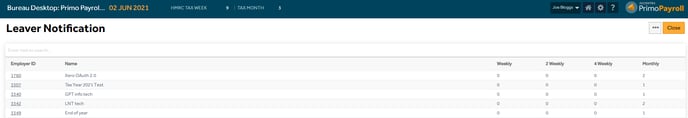

Leaver Notification Updates

The user can track records of the employees who have left employment in the current period.