This article covers auto enrolment settings, pension scheme settings and pension information in employee records.

Auto Enrolment Settings

Enter your Regulator Registration Number. The Staging Date is automatically filled in if you have provided the PAYE Reference. The other fields will be automatically filled in after you sign-up with a pension provider.

| Field Name | Description | Note |

| Enable Auto Enrolment Feature | By default, this feature is enabled. Disable it if you do not wish to use automatic enrolment. | |

| Regulator Registration Number | Enter the Pension Regulator Registration Number | |

| Pension Provider ID | Choose the Pension Provider from the list | Automatically filled-in after Sign-up |

| Staging Date | Select your Staging Date | |

| AE Postponement Months | Specify the number of months you have postponed | Automatically filled-in after Sign-up |

| Pension Scheme ID |

Select the Pension Scheme ID you wish to assign to Eligible Jobholders, Non-Eligible jobholders and Entitled Workers. |

Automatically filled-in after Sign-up |

| Scheme ID for Refund Processing | Select the Pension Scheme ID for processing refunds | Automatically filled-in after Sign-up |

| Email ID for non-email Employees | The Email ID entered here will receive the Emails which were sent to Non-Email Employees. | |

| Send SMS Confirmation | Sends SMS along with each Emails sent to the employees |

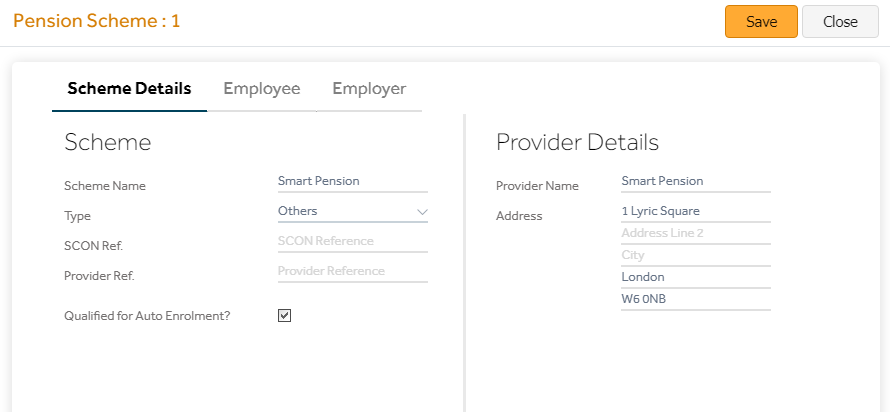

Pension Schemes Settings

These settings are automatically filled in for Smart Pension and PensionSync.

| Field Name | Description |

| Qualified for Auto Enrolment? | This is automatically set to “Yes” when signed up with a pension provider. |

| Retirement Age | You don’t need to fill this as the age calculation for assessment is taken from the payroll table |

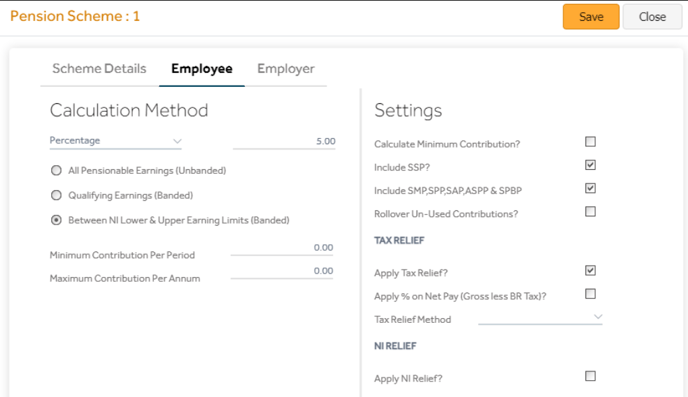

| Calculation Method | Automatically set by the program. If required, this can be changed as per the requirement. |

| All Pensionable Earnings | Pension is calculated on all pensionable earnings. |

| Between NI Lower & Upper Earning Limits | Pension is calculated only on the value between the NI lower & upper earning limits |

| Include SSP | The pension deduction will happen on the Statutory Sick pay |

| Include SMP, SPP & SAP | The pension deduction will happen on these Statutory Payments |

| Apply Tax Relief |

Tick this if you wish to deduct the pension before tax |

| Tax Relief Method: Relief by Employer |

Select this if the pension needs to be deducted before tax |

| Tax Relief Method: Relief by Pension Provider |

Select this if the pension needs to be deducted after tax (i.e. If the pension provider is getting the tax rebate on Pension from HMRC) |

| Apply NI Relief | Tick this if you wish to deduct the pension before NI (Salary Sacrifice) |

Note: For Salary Sacrifice pension scheme, tick both ‘Apply Tax Relief’ and ‘Apply NI Relief’.

Employee Record

The pension tab in the employee record has two sections, one is the main pension and the other is additional pension (used for Auto Enrolment). When you click the ‘AE’ button, it gives the below fields.

| Field Name | Description |

| Outside UK worker? | Tick this only if the employee works outside the UK or you wish to exclude the employee from Auto Enrolment. |

| AE Category |

Automatically Filled by the AE process EJH = Eligible Job Holder NEJH = Non eligible Job Holder EW = Entitled Worker |

| Date on which the employee was first classified as an eligible job holder | Date on which the employee was first classified as an eligible job holder. |

| AE Date | Automatically filled in by the program. This is the Auto Enrolled date |

| Membership ID | Filled-in automatically by the program, if provided by the pension provider. |

| Membership Start Date | Filled-in automatically by the program. Else, you can enter the Membership Start Date given by your provider. This date is used to calculate the 30days opt-out period. If this date is blank, then the program uses the AE Notified date to calculate the opt-out period |

| Opt Out Date | Automatically filled in by the program. |

| Refund Made Date | If a refund is due, this will be automatically filled-in by the program |

| Opt in Date | Automatically filled in by the program |