This article will guide you in processing the opt-in, opt-out & cease membership of the employees from a pension scheme and refunding them their pension contributions deducted, if applicable.

For Employers Integrated with a Pension Provider:

If the employer is integrated with a pension provider (i.e. the pension contributions being submitted automatically to the pension provider), then the program will automatically download the opt-in, opt-out & ceased membership details from the pension provider and process a pension refund, if applicable.

The user is not required to perform any action regarding the above.

For Employers NOT Integrated with a Pension Provider:

If the employer is NOT integrated with a pension provider (i.e. the pension contributions are being submitted to the pension provider manually), then the employer has to process the opt-in, opt-out & cease membership manually by following the below steps.

1. Process Opt-in manually

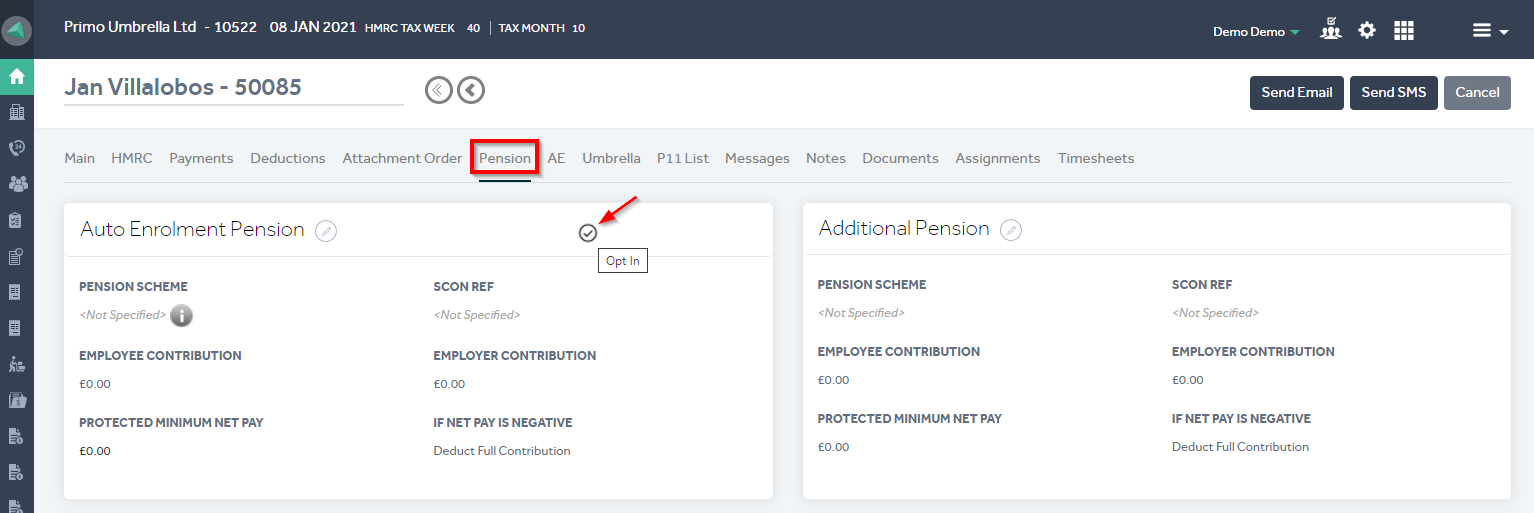

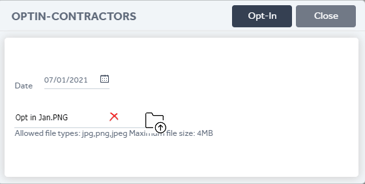

If a contractor who has been categorised as a Non-Eligible Jobholder or an Entitled Worker wants to opt-in, you can open their contractor record and from the ‘Pension’ tab, you will see the ‘Opt-in’ icon. Click this and enter the opt-in date and upload the opt-in notice given by the contractor and click Save.

2. Process Opt-out & Cease Membership manually

If a contractor who has been auto-enrolled or opted-in to a pension scheme wants to opt-out or cease their membership, you can manually do this from within the contractor record as detailed below.

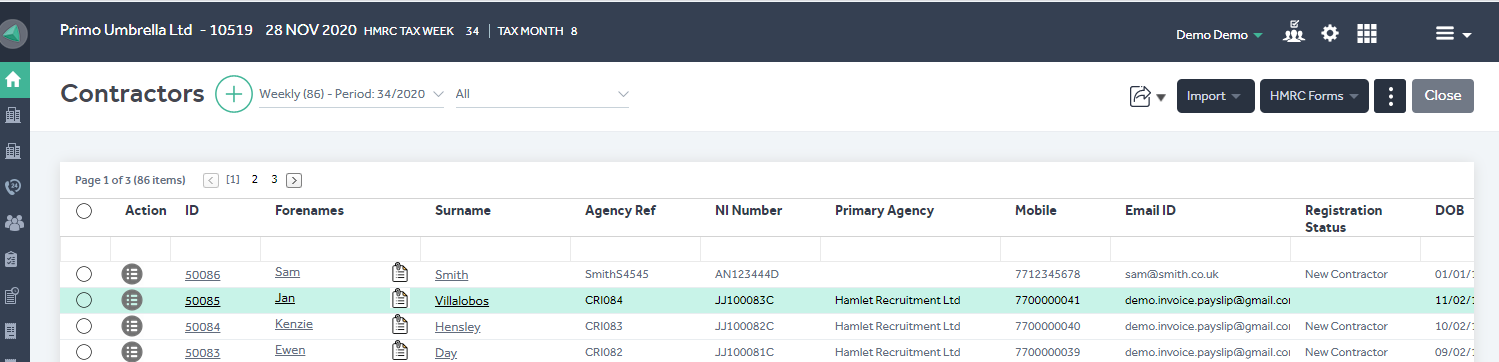

Step 1: Open the relevant contractor record from the ‘Contractors’ list and go to the ‘Pension’ tab.

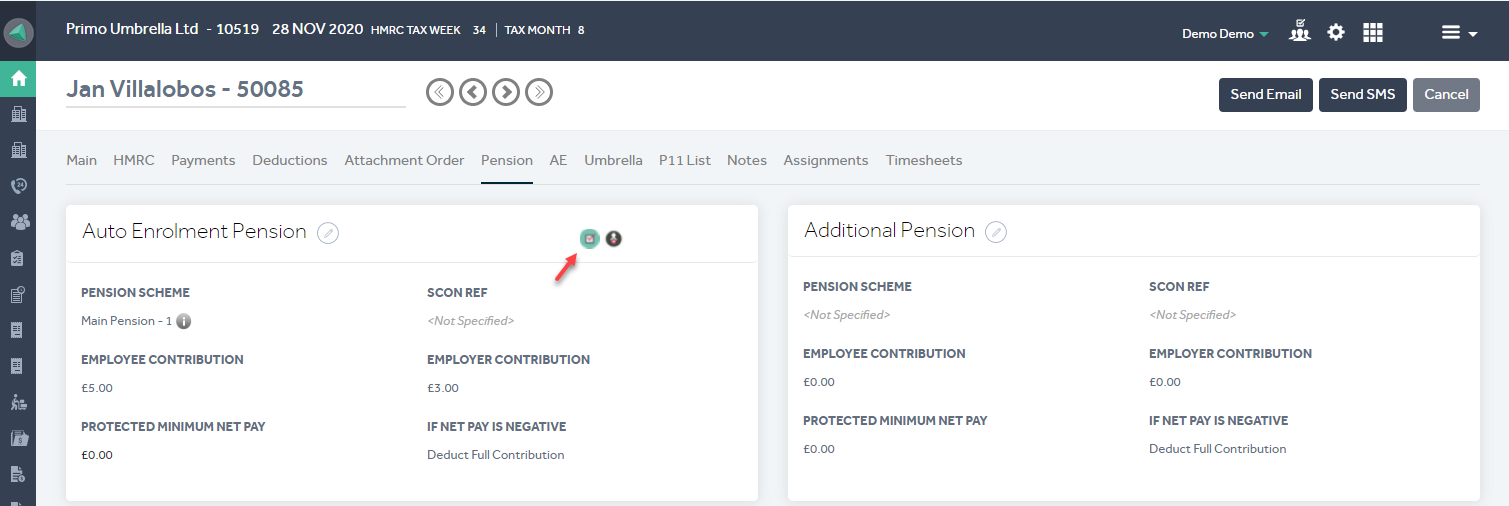

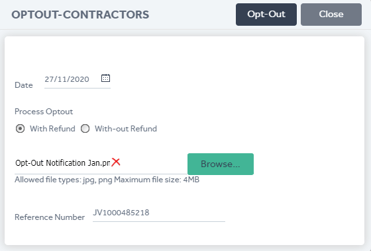

Step 2: Click the respective icon for opt-out or cease membership. Fill in the opt-out date and mention whether you wish to process a refund and upload the contractor opt-out notice. Click ‘Opt-Out’ or ‘Cease’ to complete the process.

The pension refund will be automatically made to these contractors in the next payroll run.