This article will guide you in setting up an attachment order in Primo Umbrella

Attachment Order

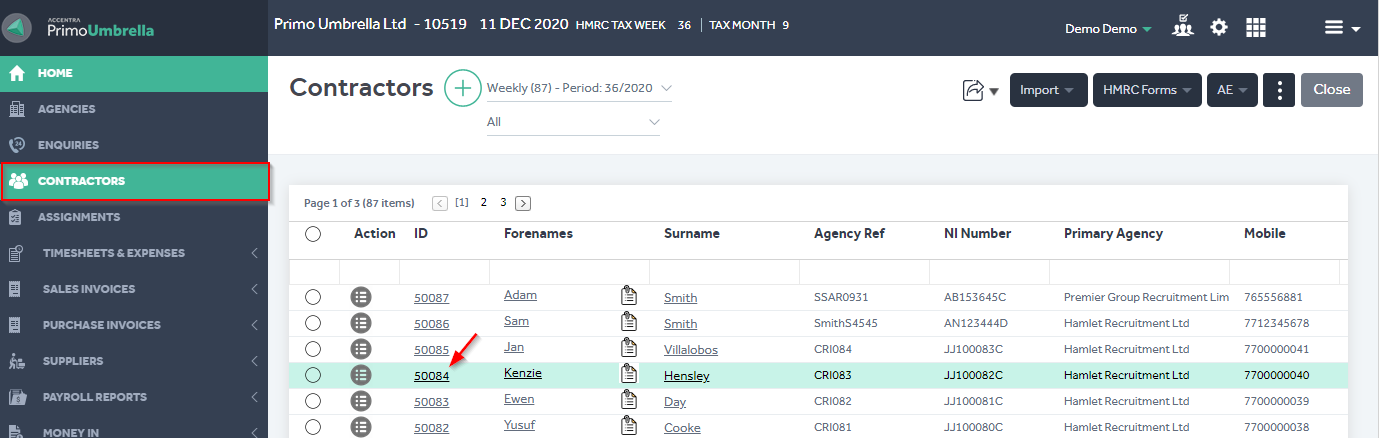

Step 1: Click ‘Contractors’ from the side menu and open the respective contractor record.

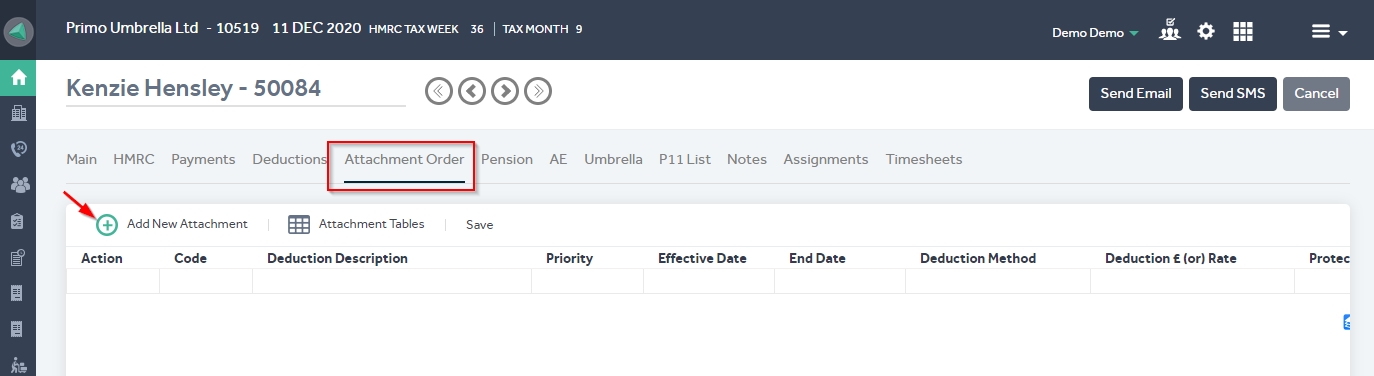

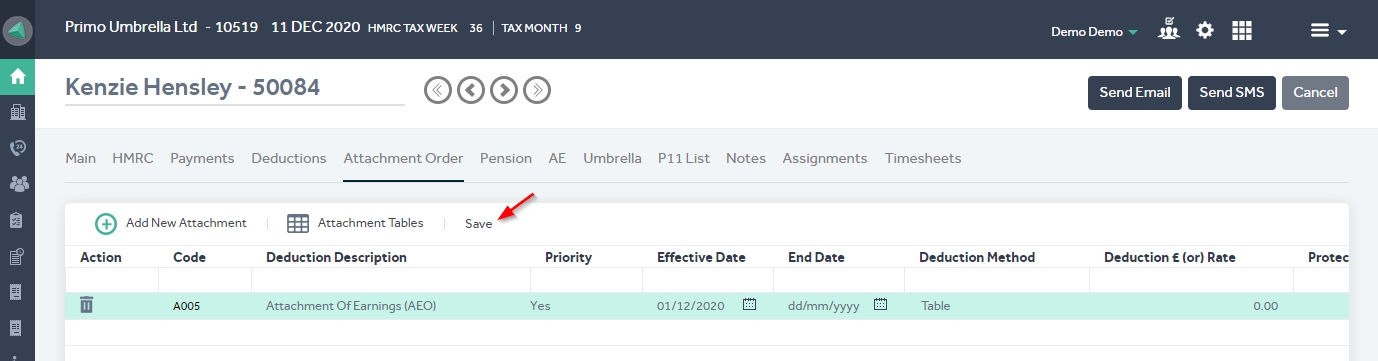

Step 2: Click the ‘Attachment Order’ tab in the contractor record and click ‘Add New Attachment’.

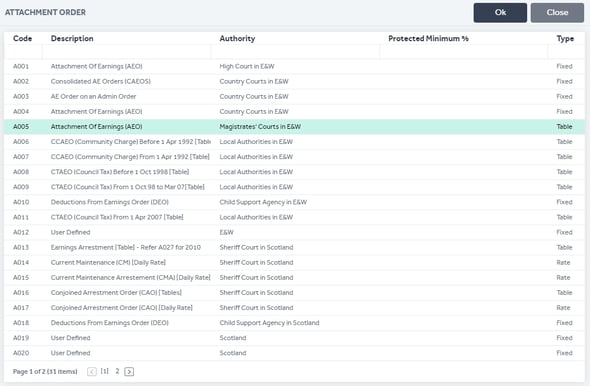

Step 3: This will show a list of all attachment orders available. You’re required to select the relevant ‘Authority’ by whom the attachment order was issued. Also, check if the deduction ‘Type’ matches with the attachment order and click OK.

Enter the attachment order details and click ‘Save’. You’ll see a confirmation message that the attachment order has been added.

| Column Name | Description |

| Priority | Should this Attachment order deduction be given the priority over other Attachment orders already set up? You’ll find this in the Attachment Order letter issued by the Authority |

| Effective date | Date from when this attachment order deduction should happen |

| Deduction or Rate | Enter the amount/rate that is to be deducted. This applies for fixed amount Attachment Orders. |

| Protected minimum | Enter the protected minimum percentage the contractor must receive |

| Order ref | The Attachment Order reference mentioned in the letter received |

| Total Attachment | The total amount of the Attachment Order that is to be deducted |

| Deduction This Period | Attachment Order deduction made in the current pay period |

| Deduction C/F | Amount of the Attachment Order deduction carried forward to the next period due to protected minimum |

| Deduction so far | Total Attachment Order amounts deducted until the current period |

| Deduction B/F | Amount of the Attachment Order deduction brought forward from the previous period due to protected minimum |

You will see the below message to confirm the Attachment order has been saved successfully.

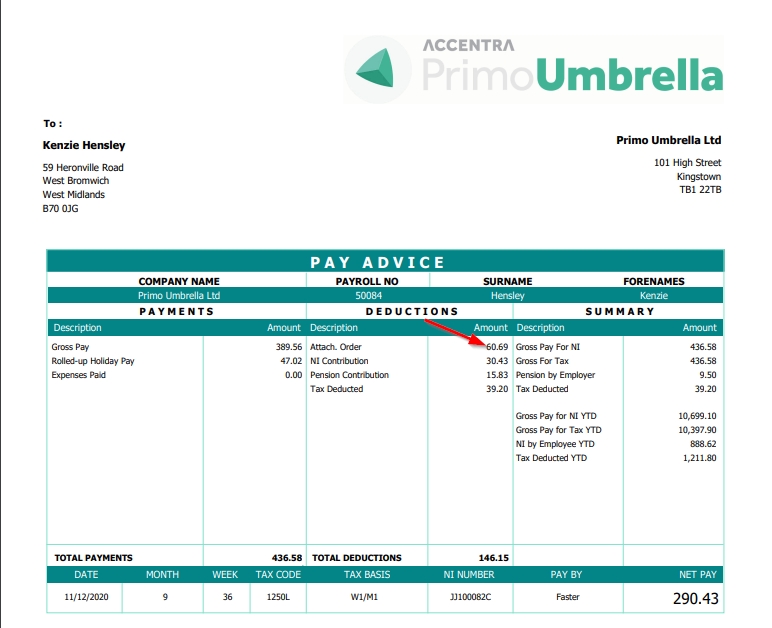

Step 6: Based on the the Attachment Order setup, the fixed/table deduction will be applied the next time the Run Payroll is done. The amount deducted will be displayed in the deductions section of the payslip.

Note: If the Run Payroll has already been done for that contractor, please re-run the payroll so that the Attachment Order deduction to happen.