This article briefly outlines auto enrolment; what it is, your key responsibilities, the current qualifying earnings limits and contribution rates.

What is Auto Enrolment?

Auto enrolment is about identifying eligible employees and enrolling them automatically at the right time to a qualified pension scheme and promptly communicate with them of their rights and entitlements. For those who don’t qualify automatically, you still have to send an appropriate letter informing of their status and right. You will have to process opt-out and opt-in notices from qualified and unqualified employees. Auto enrolment requires you to assess your workforce regularly and at least once every pay period.

The law came into force for large employers from October 2012 and smaller employers will follow. Even if you already offer pension arrangements for your workers, you'll still have some new obligations to meet.

Your Responsibilities

- Find out your staging date (the date by which you are required by law to comply with the AE legislation). Refer section Staging Date for more details.

- Identify and provide a qualifying scheme for eligible Jobholders (Jobholder is the one who works in the UK irrespective of the Nationality or Duration). Refer section Qualifying Scheme for more details.

- Automatically enroll all eligible jobholders onto the scheme.

- Pay employer contribution for eligible jobholders and non-eligible jobholders who opt-in to the scheme.

- Inform all eligible jobholders that they have been automatically enrolled and they have the right to opt-out if they want to do so.

- Offer Pensions schemes to the non-eligible Jobholders and entitled workers.

- Declare the compliance to the Pension Regulator.

Qualifying Earnings and Minimum Contributions

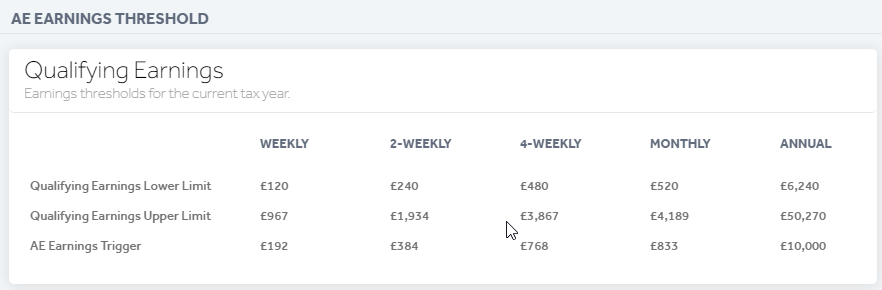

Qualifying Earnings Limit

The following table shows the Qualifying Earnings Threshold for 2020-21

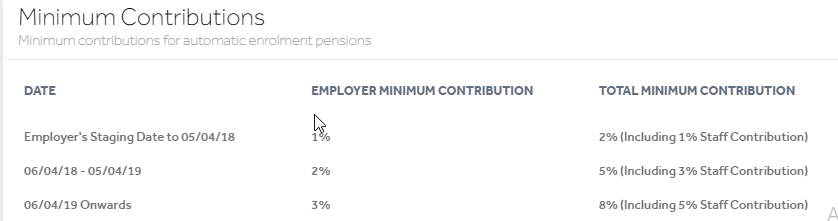

Minimum Contributions

The table below shows the minimum pension contribution rates. The rates have not changes since April 2019.

Further Guidance

For further guidance, we recommend you refer to http://www.thepensionsregulator.gov.uk/employers.aspx